by Innov8ive Marketing | Mar 13, 2021 | Uncategorized

Key Tax Changes from the American Rescue Plan Hey y’all! I wanted to take a quick minute to talk about the unemployment changes as part of the new American rescue plan, which was just recently passed by President Joe Biden. This does a couple of things. So the...

by Innov8ive Marketing | Mar 30, 2020 | Uncategorized

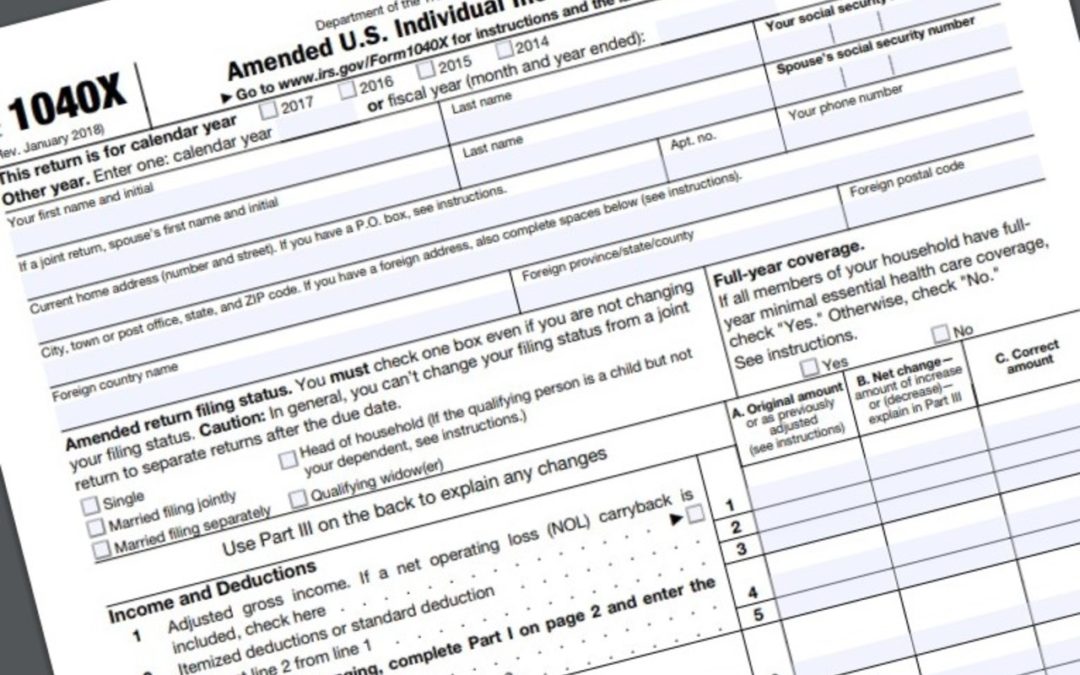

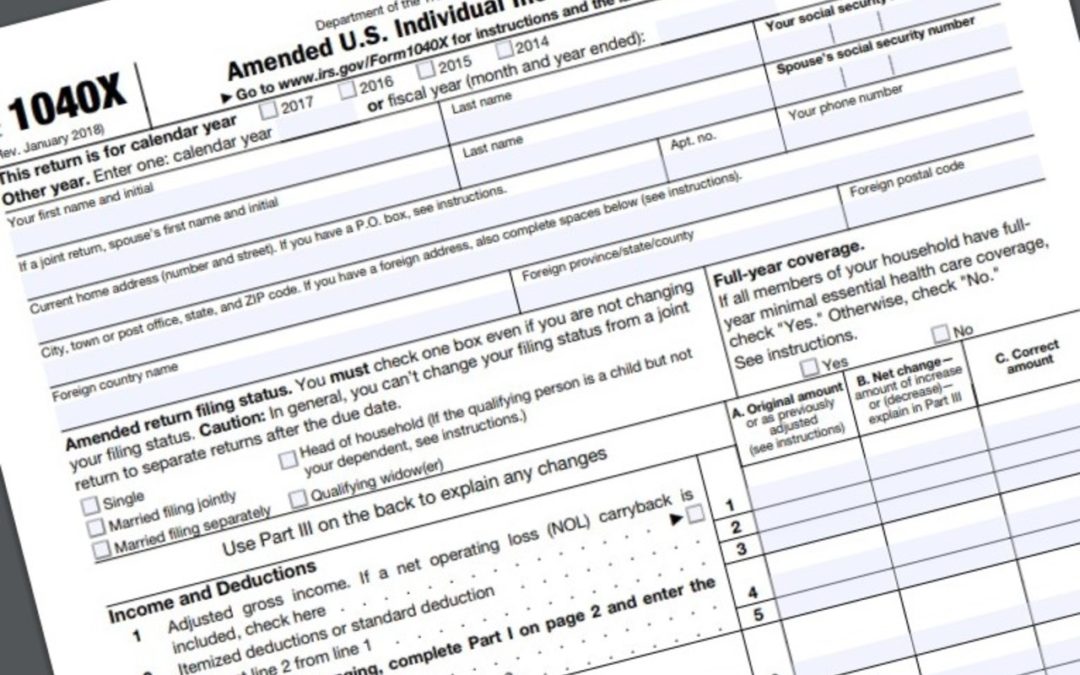

When should you amend your tax return? So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than once, but it is...

by Innov8ive Marketing | Sep 15, 2019 | blog

The Ultimate Guide to Amending Your Tax Return For many taxpayers there is minimal information necessary to file their income taxes. Other taxpayers have multiple sources of income that must be reported, as well as various deductions and credits that must be...