How We Work: Tax Preparation Process

Documents, Questionnaire, Deposit & Engagement Letter

Before starting your tax return, there are a few things we will need to collect from you. We will need a signed engagement letter, a completed intake questionnaire, a $200 deposit (or $600 for a business return) and your documents. Once all items are received, we will pass along your information to our dedicated tax team who will enter your information into your tax return.

1. Your tax documents (upload here) (here is a list of possible tax documents you may need)

2. A signed engagement letter

3. Intake questionnaire and

4. A deposit

For existing clients, we will send you a link specific to you to complete your engagement letter, questionnaire & deposit. For new clients, please contact us at 281-440-6279 and we will create one for you.

How To Login & Access the Molen & Associates Portal

Advisor Review & Meeting

After our advisory team has entered your information and reviewed your return, you will have the opportunity to meet with your advisor. Someone from our office will reach out to you by phone or email to schedule a meeting time. This time will allow you to discuss your return with your advisor and ask any questions. These meetings generally take up to 30 minutes. In-Person, Virtual, and Phone meetings are available.

We know there can be many things to consider when strategizing effectively, and we want to be as prepared as possible to answer your questions when it comes time to meet with your tax advisor. Below are topics we commonly cover in our appointments:

- Bank account information if you wish to pay the IRS or receive your refund directly

- How you’d like to sign a copy of your return when completed

- Any tax questions (please send any applicable questions prior to the meeting)

- Check your withholding or estimated payments (please bring your two most recent pay stubs)

- Any major changes for the future year (change in filing status, dependents, or new business ventures)

Click “here” for a comprehensive list of topics you may like to discuss based on your tax situation

Missing Info & Payment

During the meeting with your advisor, new information may come to light and additional information or documentation is required. You will be sent an email listing the “missing information”. Follow up calls and emails will occur until all information needed for your return is received.

After discussing your return with the advisor, we will collect final payment. This final payment reflects the remaining balance for your tax return, after the initial deposit has been applied.

How To Upload Documents To The Molen & Associates Portal

Tax Return Finalized, Delivered & Signed

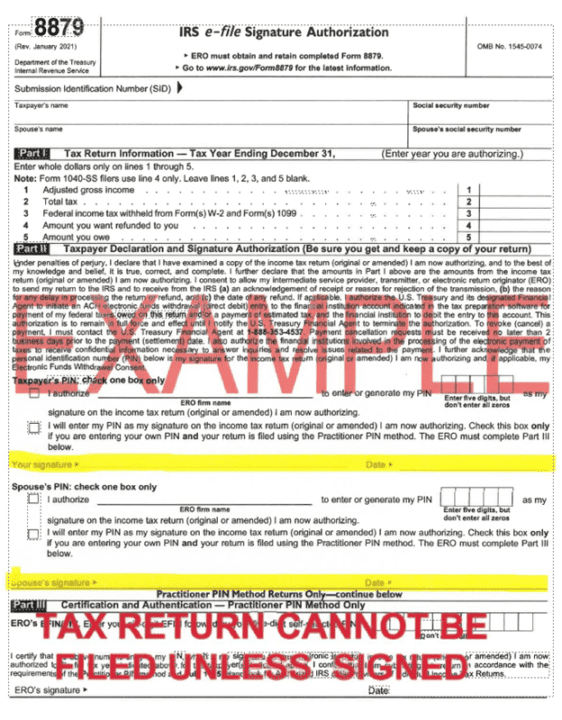

Once payment is received, we will prepare our return for you to review and sign. We will send the completed return to you based on the delivery method you chose in the questionnaire or discussed with your advisor. Once you have received and reviewed the return, it is required that all parties named on the 8879 sign (single or married filing separate will require one signature, married filing jointly requires two signatures). Once signed please return form 8879 to us for eFiling. You can come to our office to sign in person or you can sign electronically through Docusign.

If you have elected to review and sign your return via DocuSign, we will send you a signature request from the DocuSign platform to the email(s) specified during your tax appointment. Each signing party will have their own request and need to verify their identity by correctly answering all security questions. Molen & Associates is has no control over the questions asked, as the IRS pulls these based on records they have related to your SSN. When you are ready to sign, DocuSign will automatically prompt the Taxpayer and/or Spouse to sign only in their designated spot within their request. If you are filing jointly, it is crucial that BOTH signatures are obtained to complete the form. Once the return is signed by all parties, you will be given the option to download the return file to your device.

eFiling

After we receive the signed form 8879 we will eFile your return on your behalf. eFiling increases the speed, security, and accuracy of our tax preparation services. It also helps you get your refund faster! Most electronically filed tax returns prepared with our tax service are received within 8 to 15 days. A paper tax return sent through the US Mail takes anywhere from 6 to 8 weeks. Once the return is eFiled, you will be able to track the status of your return using the “Where’s My Refund?” IRS tool.

Repeat!

FAQ

What If I Can’t File by the Deadline?

There are many reasons why you won’t be able to file on time: bookkeeping being behind schedule, tax forms not yet arrived, the dog ate your homework, etc. If you can’t file by the business or individual filing deadline, you can always file an extension. At Molen & Associates, we file extensions for you at no cost. We just ask that you complete the extension request form via THIS link prior to our deadline. There is no downside to filing an extension. However, please note that filing an extension gives you more time to file, but does not extend your time to pay any tax due.

How do I sign my return via DocuSign?”

If you have elected to review and sign your return via DocuSign, we will send you a signature request from the DocuSign platform to the email(s) specified during your tax appointment. Each signing party will have their own request and need to verify their identity by correctly answering all security questions. When you are ready to sign, DocuSign will automatically prompt the Taxpayer and/or Spouse to sign only in their designated spot within their request. If you are filing jointly, it is crucial that BOTH signatures are obtained to complete the form. Once the return is signed by all parties, you will be given the option to download the return file to your device.

How to Correctly Sign my 8879 via Portal”

Once you have reviewed the return and are ready to file, please print and apply a wet signature and date on the form(s) as instructed on the first page of your tax return. If you are filing jointly, it is crucial that BOTH signatures are obtained to complete the form(s). You can then return the signed form(s) to us through the portal, via fax, or in person.

How Long Until I Receive My Refund?

If you’re eager to get your hands on your tax refund, you’re not alone. If you came in for your appointment within the last seven days and brought all of the required documents, we are still working on your return. You can learn more about our “Seven-day Process” here. However, once it leaves our hands and is filed with the IRS, you can still get updates on the status of your tax refund. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency at 800-829-1040.

One of IRS’ most popular online features gives you information about your federal income tax refund. The tool tracks your refund’s progress through 3 stages:

- Return Received

- Refund Approved

- Refund Sent

You get personalized refund information based on the processing of your tax return. The tool provides the refund date as soon as the IRS processes your tax return and approves your refund.