by Clark Boyd | Mar 29, 2021 | Uncategorized

The Importance of Financial Literacy in Childhood When I was a kid, I always enjoyed earning a few dollars doing chores and mowing lawns. My sister and I would work hard to earn $5 picking up pine needles for our dad but had very different ideas on how to spend it. I...

by Clark Boyd | Mar 22, 2021 | Uncategorized

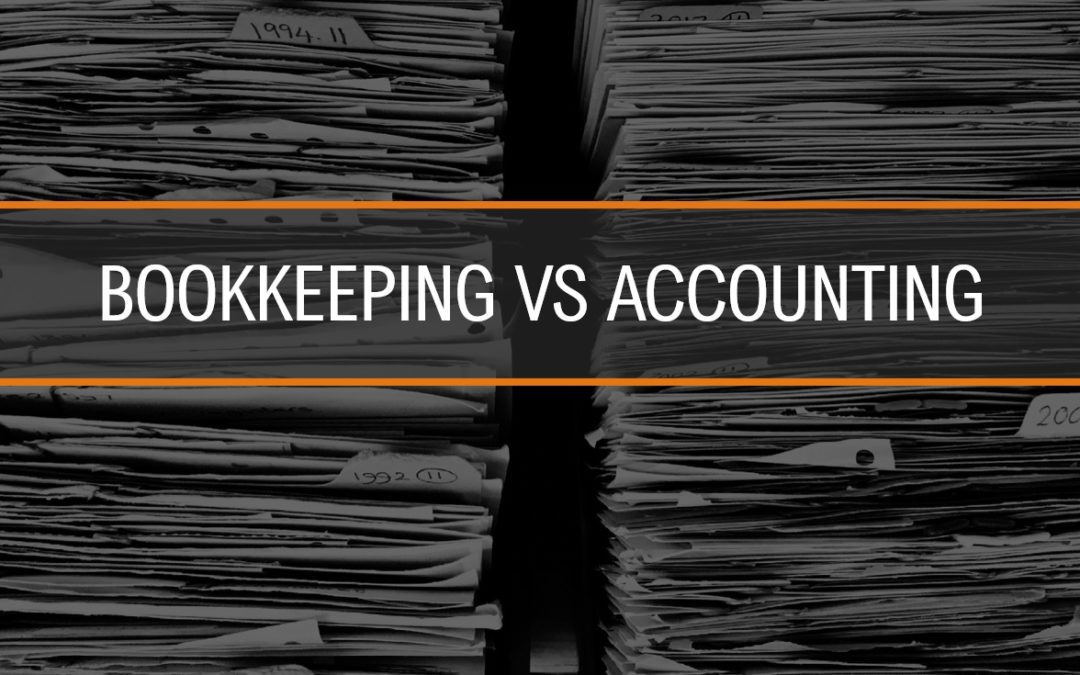

How to Transition from Bookkeeping to Accounting There is often a misconception that bookkeeping and accounting are the same thing. While bookkeeping and accounting are both essential functions, there are some important distinctions between the tasks of a bookkeeper...

by Clark Boyd | Mar 14, 2021 | Uncategorized

Surprising Impacts of Delaying Retirement by a Year What is retirement? The definition of retirement is “the action or fact of leaving one’s job and ceasing to work.” While most of us intend to stop working entirely by age 65, many Americans must continue...

by Clark Boyd | Mar 13, 2021 | Uncategorized

Is the Child Tax Credit Increasing Due To the American Recovery Act? Hey, folks, just want to take a quick minute or two to talk about the changes to the child tax credit. So the American rescue plan was just signed into law just recently by President Joe Biden....

by Clark Boyd | Mar 13, 2021 | Uncategorized

Key Tax Changes from the American Rescue Plan Hey y’all! I wanted to take a quick minute to talk about the unemployment changes as part of the new American rescue plan, which was just recently passed by President Joe Biden. This does a couple of things. So the...