by SEO | Sep 8, 2023 | Uncategorized

How Is the IRS Cracking Down on S-Corp Salaries? The IRS is turning its attention to S-Corporations (S-Corps) and the salaries paid to shareholder-employees. Ensuring that you are paying yourself a “reasonable compensation” is crucial to staying compliant...

by SEO | Jun 30, 2023 | Uncategorized

QuickBooks and Audits: Your Essential Protection Guide The advancement of technology has revolutionized numerous aspects of our lives, including the realm of tax and accounting. With the advent of online tax programs and dedicated accounting software like QuickBooks,...

by SEO | Sep 21, 2020 | Uncategorized

Steps to Optimize Your Bookkeeping System Successful businesses need good bookkeeping to maintain your finances, monitor budgets and stay tax compliant. Bookkeeping can make a huge difference and help your business grow. It can help maximize your business’s income as...

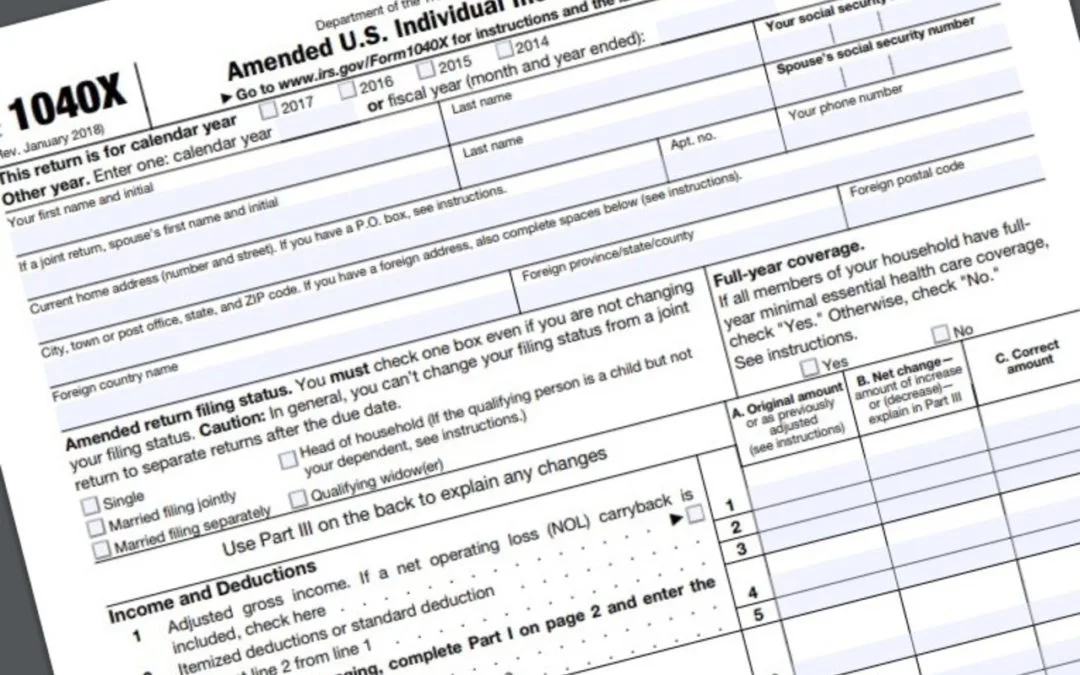

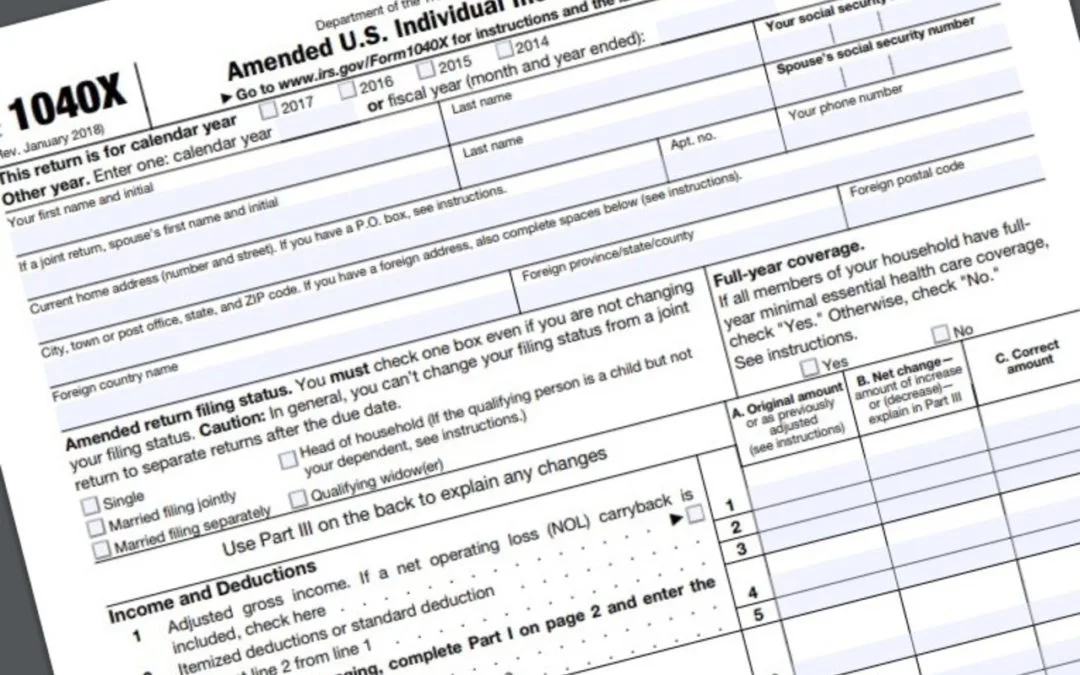

by SEO | Mar 30, 2020 | Uncategorized

When should you amend your tax return? So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than once, but it is...

by SEO | Aug 25, 2019 | IRS

Navigating the Uncertainty of IRS Audit Durations In most cases, the statute of limitations grants the IRS a period of up to three years in which to initiate an audit of a taxpayer. The three-year clock begins counting down from the latter of the following dates: The...