by SEO | Jan 10, 2023 | Uncategorized

Tax Refunds May Be Smaller This Year Plan now to learn these 2023 tax tips avoid surprises in the future! If you’re expecting a tax refund in 2023, it may be smaller than last year, according to the IRS. Your annual balance is based on taxable income, calculated by...

by SEO | Sep 26, 2022 | Uncategorized

IRS declared independent contractors as employees: Can Section 530 help? Are you going through an IRS audit? Though we know that is bad but what happens if the IRS declares that many of your 1099 independent contractors are W-2 employees, now what? Safe-harbor...

by SEO | Sep 1, 2022 | Uncategorized

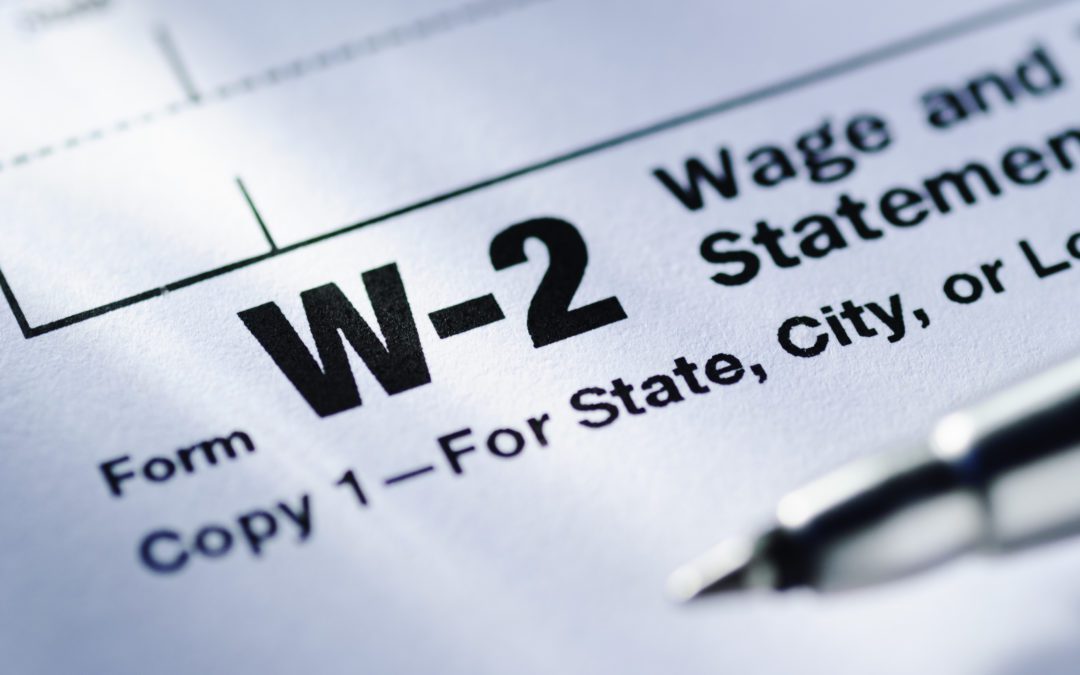

Click Here for a Full List of W2 vs 1099 Descriptions What is the difference in Independent Contractors VS Employees If you have found yourself asking why your boss has paid you as a 1099 independent contractor instead of a w-2 employee, look no further. There are...

by SEO | Nov 26, 2021 | Uncategorized

The Impact of Bonus Taxes on Your Financial Planning Are you bringing in a bonus this year? Fantastic! You should be proud of your hard work. I teach my three kids the same fundamental principle every week. Hard work pays off. It’s completely ingrained in them now....

by SEO | Jun 23, 2021 | Uncategorized

2022 Update on Advanced Payments for the Child Tax Credit 2021 Launch of the Advanced Payments of the Child Tax Credit Unenroll for Advance Payments of Child Tax Credit Maximizing Your Benefits with the Expanded Child Tax Credit The American Rescue Plan had more...