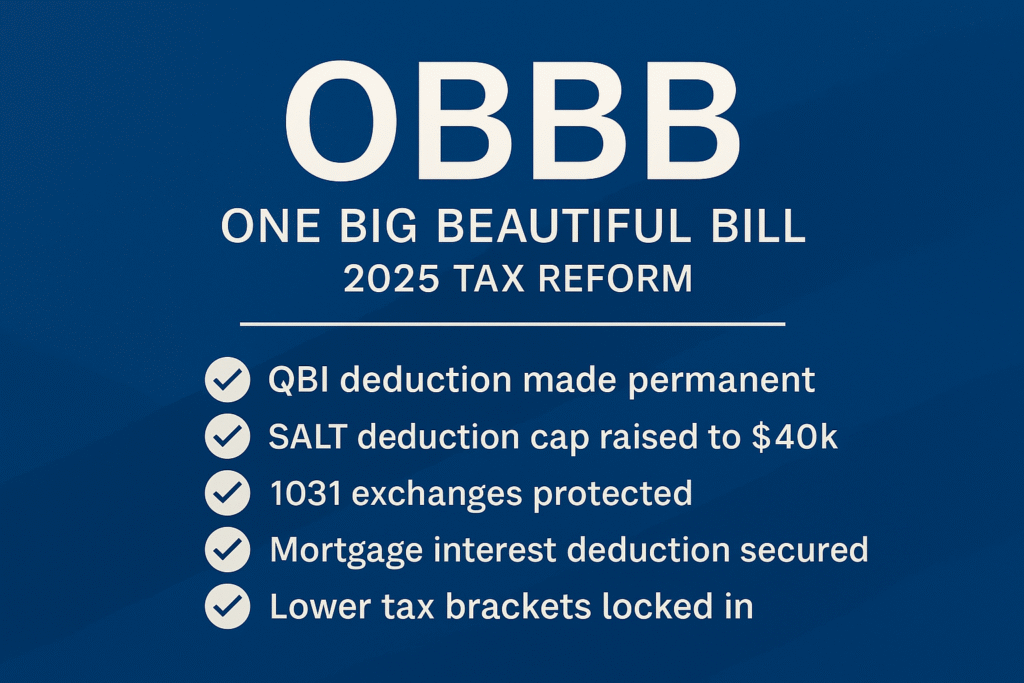

On July 1, 2025, the U.S. Senate passed one of the most significant tax reform bills in recent history: the One Big Beautiful Bill (OBBB). With the House expected to approve the final version shortly and a presidential signature likely to follow, this sweeping legislation brings major changes for individuals, small business owners, REALTORS®, and real estate investors.

At our firm, we’ve reviewed the bill carefully to break down the key provisions that matter most to our clients. Here’s what you need to know.

💼 1. The 20% QBI Deduction Is Here to Stay — and It’s Even Better

If you’re a sole proprietor, S-Corp owner, or independent contractor (including real estate agents), the Qualified Business Income (QBI) deduction under Section 199A is a game changer. This bill makes the 20% QBI deduction permanent, removing the 2025 sunset provision and adding enhancements to make it clearer and more accessible. If you’re self-employed, this is a powerful tax-savings tool that just became more reliable for long-term planning.

🧾 2. SALT Cap Quadrupled for Five Years

The bill temporarily raises the State and Local Tax (SALT) deduction cap from $10,000 to $40,000 for the years 2025–2029. For clients in high-tax states, this provides much-needed relief and opens the door to larger itemized deductions, especially when combined with mortgage interest and charitable giving.

🏠 3. Mortgage Interest Deduction Permanently Preserved

Good news for homeowners and homebuyers: the mortgage interest deduction remains intact and permanent. This ensures ongoing tax benefits for those investing in homeownership — a key element in building wealth and financial stability.

🔁 4. 1031 Like-Kind Exchanges Are Safe

The bill protects 1031 exchanges, allowing real estate investors to continue deferring capital gains taxes when swapping investment properties. This is a cornerstone strategy for real estate professionals and investors seeking to scale their portfolios while managing tax exposure.

💵 5. Lower Individual Tax Rates Made Permanent

One of the bill’s most widely supported provisions is the permanent extension of lower individual income tax brackets. Originally scheduled to expire after 2025, these tax rates are now locked in — a significant win for individuals, married couples, and small business owners alike.

🧒 6. Child Tax Credit Increased to $2,200 (and Indexed for Inflation)

The Child Tax Credit has been permanently increased to $2,200, with future indexing to inflation. For families, this means more relief during tax time and stronger financial support for raising children in a high-cost economy.

👪 7. Estate and Gift Tax Exemption Locked at $15 Million

The bill permanently sets the federal estate and gift tax exemption at $15 million, adjusted for inflation. This is a crucial safeguard for clients with real estate or business assets planning to transfer wealth to the next generation.

🏭 8. Bonus Depreciation and Business Expensing Restored

The bill reinstates 100% bonus depreciation and full expensing for certain capital investments, including research & development costs and some industrial buildings. This is a major incentive for business growth and equipment upgrades — especially for manufacturing, agriculture, and real estate operations.

🌍 9. Opportunity Zones Enhanced

Opportunity Zones are revived and expanded under the new law, with updated incentives targeting investments in underserved communities — both rural and urban. For clients interested in long-term real estate or business investment strategies, these zones now offer even more potential.

🍼 10. “Baby Bonds” Introduced

A new provision creates a $1,000 government-funded savings account for every child born after the bill is enacted. These accounts will grow over time and can be used toward first-time home purchases or education, offering a head start in financial independence and wealth building.

📌 What Should You Do Now?

With most provisions set to take effect January 1, 2025, now is the time to revisit your tax planning strategy. Consider the following:

- If you’re self-employed or a small business owner, confirm your QBI eligibility and revisit your entity structure for optimization.

- If you’re a REALTOR® or investor, take advantage of permanent mortgage interest and 1031 protections.

- If you’re planning a large gift or estate transfer, use the current $15M exemption for tax-efficient planning.

- If you’re in a high-tax state, evaluate whether the new SALT cap allows you to itemize again.

💬 Final Thoughts

This legislation is a rare alignment of pro-business, pro-real estate, and pro-family tax policy. Whether you’re a seasoned investor, new entrepreneur, or growing family, the One Big Beautiful Bill presents new planning opportunities and potential tax savings.

If you’d like to review how these changes affect you, we’re here to help. Book a tax strategy session with our team to explore your personalized roadmap under the new law.