How To Pay Your Children From Your Business

Paying your children through your business can be a strategic way to manage your business’s taxable income, while also providing your children with income and potentially teaching them about the value of work. While it is a great strategy, there is a lot to consider and ensure you execute the strategy correctly to not end up in trouble!

Benefits of paying your children from your business

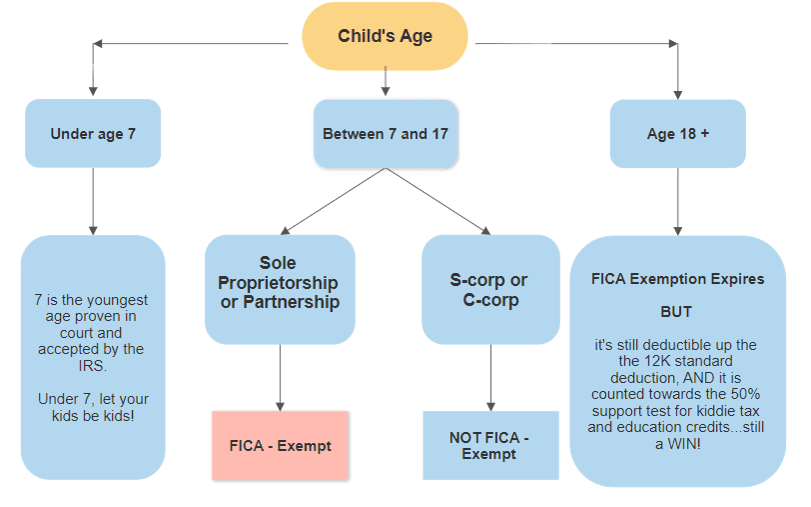

Payments to your children can be deductible as business expenses, reducing your taxable income. For sole proprietorships and LLCs treated as sole proprietorships, payments to children under 18 are exempt from Social Security and Medicare taxes.

Payments to children under 21 are exempt from federal unemployment tax. If your business is an S corporation, the child must be a legitimate employee, and the same rules about reasonable compensation and job duties apply. However, wages paid to your child are subject to federal employment taxes, regardless of the child’s age.

Let me run through two examples to show you how this would work:

To illustrate the tax implications of paying your child, below in scenario 1 is a sole proprietor paying taxes as he or she normally would. The scenario assumes 2023 tax rates and a married joint filing status. The second scenario is the exact same, but the business pays $13,000 in W2 wages to their child. We’ll break down the calculations step by step. Please note, these calculations are simplified and assume standard deductions. Actual tax liabilities could vary based on a variety of factors including additional income, deductions, credits, and specific tax laws.

Scenario 1: Without Paying Wages to a Child

Business Income:

- Revenue: $200,000

- Expenses: $100,000

- Net Profit: $100,000

Parent’s Federal Income Tax and Self-Employment Tax:

- Self-Employment Tax: The self-employment tax rate is 15.3% on the first $147,000 of combined wages, tips, and net earnings in 2023. The tax applies to 92.35% of net earnings from self-employment.

- Taxable Earnings for Self-Employment Tax = $100,000 * 92.35% = $92,350

- Self-Employment Tax = $92,350 * 15.3% ≈ $14,129.55

- Federal Income Tax: Assuming the couple files jointly, the standard deduction for married filing jointly in 2023 is $27,700. Taxable income for income tax purposes would be net profit minus half of the self-employment tax minus the standard deduction. In this scenario, we won’t account for any state income taxes, but this would add to the tax savings!

- Adjusted Gross Income (AGI) = $100,000 – ($14,129.55 / 2) = $92,935.23

- Taxable Income = AGI – Standard Deduction = $92,935.23 – $27,700 = $65,235.23

- Federal Income Tax: This would fall within the 12% marginal tax bracket for married filing jointly, but since U.S. federal income tax is progressive, the actual calculation would need to account for the income taxed at both the 10% and 12% rates. For simplicity, let’s approximate the tax using a 12% rate.

- Approximate Federal Income Tax ≈ $65,235.23 * 12% ≈ $7,828.23

Total Parent Tax:

$14,129.55 (Self-Employment) + $7,828.23 (Income Tax) ≈ $21,957.78

Scenario 2: Same Business Income but Pay $13,000 in Wages to a Child

Parent’s Taxes with Wages Paid:

- New Business Net Profit = $100,000 – $13,000 = $87,000

- Self-Employment Tax on $87,000 (Adjusted as above) ≈ $12,359.91

- Adjusted Gross Income = $87,000 – ($12,359.91 / 2) ≈ $80,820.05

- Taxable Income after Standard Deduction = $80,820.05 – $27,700 = $53,120.05

- Approximate Federal Income Tax (assuming a similar effective rate) ≈ $53,120.05 * 12% ≈ $6,374.41

Child’s Taxes:

- W-2 Wages: $13,000

- Standard Deduction for a dependent in 2023: $13,850 (This is the standard deduction for single filers in 2023)

- Taxable Income: $0 (since the wages are below the standard deduction)

- Federal Income Tax: $0

Total Family Tax:

- Parent’s Taxes: $12,359.91 (Self-Employment) + $6,374.41 (Income Tax) ≈ $18,734.32

- Child’s Taxes: $0 (Income Tax) + $994.50 (FICA Taxes on $13,000 at 7.65%) = $994.50

- Total: $18,734.32 (Parent) + $994.50 (Child) = $19,728.82

Summary:

- Without Wages to Child: Total Taxes = $21,957.78

- With Wages to Child: Total Taxes = $19,728.82

RESULT : $2,228.96 in taxes saved

Paying wages to the child not only provides them with income but also reduces the overall tax liability for the family by shifting some of the income to the child, who is in a lower tax bracket (effectively zero in this case for income taxes). This example simplifies the calculations and does not consider other potential tax benefits or obligations. If your income is higher, this amount of tax savings can be even greater.

p.s. if you are in this situation and you are paying a lot if self employment taxes, don’t forget to read our article about electing to be taxed as a S-Corp. (LINK HERE)

Items to Remember Before Paying Your Child

If you think this strategy may be right for your business, here are a few items to remember and be aware of before you start paying your child:

- Formal Employment Relationship: Ensure there is a formal employment relationship. This means issuing paychecks, withholding taxes as necessary, and maintaining accurate and detailed records of their work and compensation.

- Reasonable Compensation: The compensation must be reasonable for the work performed. Paying your child an inflated wage for minimal tasks could attract scrutiny from the IRS. If you’d like help determining a reasonable wage, let us know! We have access to industry and location data to determine what the IRS would consider a reasonable wage so you don’t have an increased risk of an audit.

- Work Must Be Necessary and Appropriate: The work performed by the child must be necessary for your business operations and appropriate for their age and skill level.

- Follow Labor Laws: Adhere to federal and state labor laws regarding employment of minors, including restrictions on the types of work they can do and the hours they can work.

- Issue a W-2 Form (as well as other quarterly and annual payroll reports*): If your child is under 18 years old and works in your unincorporated business, their wages are not subject to Social Security and Medicare taxes (FICA) or Federal Unemployment Tax Act (FUTA) taxes. This exemption, however, does not apply if you pay them as an independent contractor. By paying them as employees, you can take advantage of these tax benefits, which are not available through 1099 payments.

If your child is an employee, you need to issue a W-2 form for them, even if you are not required to withhold income tax from their wages. Paying your child as an employee simplifies their tax situation. Wages from a W-2 can be straightforward to report, and in some cases, if the income is below the standard deduction for a single filer, they may not owe any federal income tax. Independent contractors (1099), on the other hand, must pay self-employment taxes on their net earnings if they exceed $400, which complicates their tax filing.

Additionally, The IRS has strict guidelines to determine whether someone is an employee or an independent contractor. These guidelines focus on the degree of control and independence in the relationship. Children working in a parent’s business are often considered employees because the parent controls the work performed and how it is done. Misclassifying an employee as an independent contractor can lead to penalties and interest on unpaid taxes.

- Document Everything: Keep detailed records of the work performed by your child, including job descriptions, hours worked, and payments made. This documentation is crucial in case of an IRS audit.

- Consult a Tax Professional: Given the complexities of tax laws and potential changes, it’s wise to consult with a tax professional who can provide advice tailored to your specific situation and ensure compliance with all applicable laws and regulations.

If all of this is making sense so far and you’d like to begin implementing this strategy, now comes the fun part!

Quarterly & Annual payroll reports needed to pay your child from your business

When you are paying your children from your business, you are generally required to file both annual and quarterly payroll reports, assuming your children are classified as employees. The specific forms and requirements can vary based on the structure of your business and other factors. Here’s a breakdown of the typical reporting requirements:

Quarterly Payroll Reports

- Form 941, Employer’s Quarterly Federal Tax Return: This form is used to report wages you’ve paid, federal income tax withheld, and both the employer’s and employee’s share of social security and Medicare taxes. Form 941 is filed quarterly. For each quarter, it is generally due by the last day of the month following the end of the quarter. However, if your business qualifies as a small business and has been notified by the IRS, you might be eligible to file Form 944 instead.

- State-Specific Reports: In addition to federal reporting, most states require quarterly reporting for state income tax withholding and unemployment insurance taxes. The specific forms and requirements vary by state.

Annual Payroll Reports

- Form W-2, Wage and Tax Statement: At the end of the year, you must provide a Form W-2 to each employee, including your children if they are classified as employees. This form reports their annual wages and the amount of taxes withheld from their paychecks.

- Form W-3, Transmittal of Wage and Tax Statements: Along with providing Form W-2 to your employees, you must also submit Form W-3 to the Social Security Administration. Form W-3 is a summary of all the W-2 forms issued by your business.

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return: This form reports your annual Federal Unemployment Tax Act (FUTA) tax. FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs.

Special Considerations for Family Employees

- Children Employed by Parents: The employment of children by their parents has special rules. For example, payments for the services of a child under the age of 18 who works for their parent in a trade or business are not subject to social security and Medicare taxes if the business is a sole proprietorship or a partnership in which each partner is a parent of the child. Additionally, the wages of a child under 21 are not subject to FUTA tax. However, these wages are subject to income tax withholding regardless of the child’s age.

- Form 944, Employer’s Annual Federal Tax Return: Small business employers who have been notified by the IRS to file Form 944 may file this form annually instead of filing Form 941 quarterly. This option is designed for the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less).

It’s important to accurately classify your children as employees and comply with all reporting requirements to avoid penalties. If this sounds like a lot of paperwork to keep up with, don’t worry – there are software you can pay a small fee to take care of the payroll, reporting and compliance for you. Feel free to contact us and we can match you with a provider that fits your scenario.

Want even more tax savings for your child?

If you’d like to take the strategy of paying your children to another level of tax savings, don’t forget to maximize the use of a Roth IRA! This can be an excellent way to introduce them to savings and investing, and it can provide them with a tax-free income in retirement. Because the money was likely earned tax free and will grow tax free over time, it is a great way to build generational wealth. If by age 18, your child has invested $20k in a Roth IRA, if it grows at 7%, they will have almost $500k by the time they are age 65.

Additional Sources:

https://www.irs.gov/retirement-plans/calculation-of-plan-compensation-for-sole-proprietorships

https://www.irs.gov/pub/irs-prior/p15–2021.pdf

https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business

https://www.irs.gov/taxtopics/tc407

https://www.irs.gov/businesses/small-businesses-self-employed/sole-proprietorships

https://www.irs.gov/taxtopics/tc758

https://www.irs.gov/businesses/small-businesses-self-employed/forms-for-sole-proprietorship

https://www.irs.gov/faqs/small-business-self-employed-other-business/starting-or-ending-a-business

https://www.irs.gov/faqs/small-business-self-employed-other-business