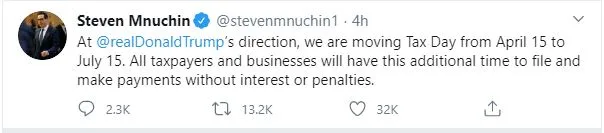

***EDIT: On 3/20/2020, “All taxpayers and businesses will have this additional time to file and make payments without interest or penalties,” Mr. Mnuchin said on Twitter.***

Here’s the short and sweet answer: The tax-filing deadline will remain April 15, but the IRS will waive penalties and interest on tax payments for 90 days. The IRS views filing and paying as two separate events. This extension is only an extension of payment.

Recap of Steven Mnuchin Address on Tax Relief

Today during the White House’s daily coronavirus briefing, Treasury Secretary Steven Mnuchin announced that the IRS would allow taxpayers to defer some payments.

“If you owe a payment to the IRS, you can defer up to $1 million as an individual — and the reason why we are doing $1 million is because that covers lots of pass-throughs and small businesses — and $10 million to corporations, interest-free and penalty-free for 90 days. All you have to do is file your taxes, you’ll automatically not get charged interest and penalties,”

Some states have rolled out delays due to coronavirus. For instance, California is granting a 60-day delay for affected individuals and businesses unable to file on time.

Mnuchin also encouraged Americans who can file their taxes by the April 15 deadline to do so and assured that refund issuance will not be affected for those who file. The IRS has processed more than 65 million income tax returns as of March 6. Of these, 52.7 million filers received tax refunds, averaging $3,012, according to the agency.

At this time, we now have a good idea what the tax relief package will look like but there is a lot of misinformation in the media so please be sure to check with a qualified professional before making any assumptions. The tax deadline has NOT been extended and is still April 15, 2020.

Why Should I File My Taxes Now?

The IRS is not extending the tax deadline, so if you don’t file by April 15, you may still be charged a separate penalty for not filing. The last day for an appointment to prepare your 2019 individual taxes before deadline will be on Saturday, April 11th, 2020. As a technology-enabled firm, we are prepared to serve you virtually through our secure online portal and phone appointments to still be able to complete your tax responsibilities before the April 15th deadline.

Can I File An Extension?

If you are unable to schedule an appointment or If you are still waiting for tax documents such as K1s or 1099s, we are able to file free extensions so that you do not have to worry about the April 15 deadline.

In order for us to file an extension on your behalf, please complete and send us the extension form found at this link. Extension forms must be received by 12pm on April 15th.

Ongoing Tax Updates

As the popular saying goes, “The devil is in the details”. This is especially true with taxes. We hope that more clarifications will come as to the exact details of the COVID-19 tax relief. As these updates become available, we will keep you updated. Join our mailing list or keep checking back for details.