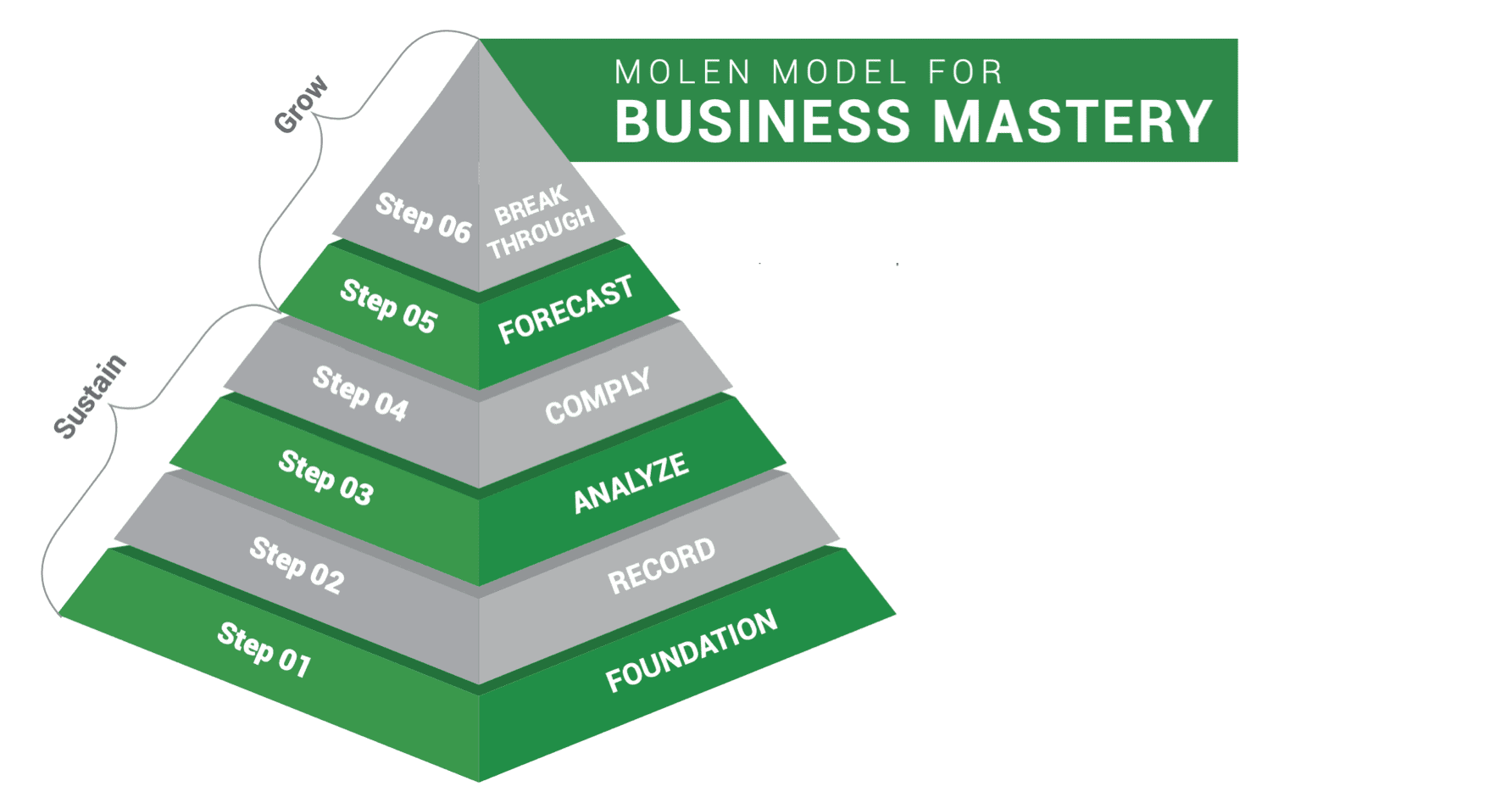

Foundation

Proper Entity, Plan or Vision, Budget, Systems & Processes, Marketing, Accountability, Customer Service, Competitive Advantage

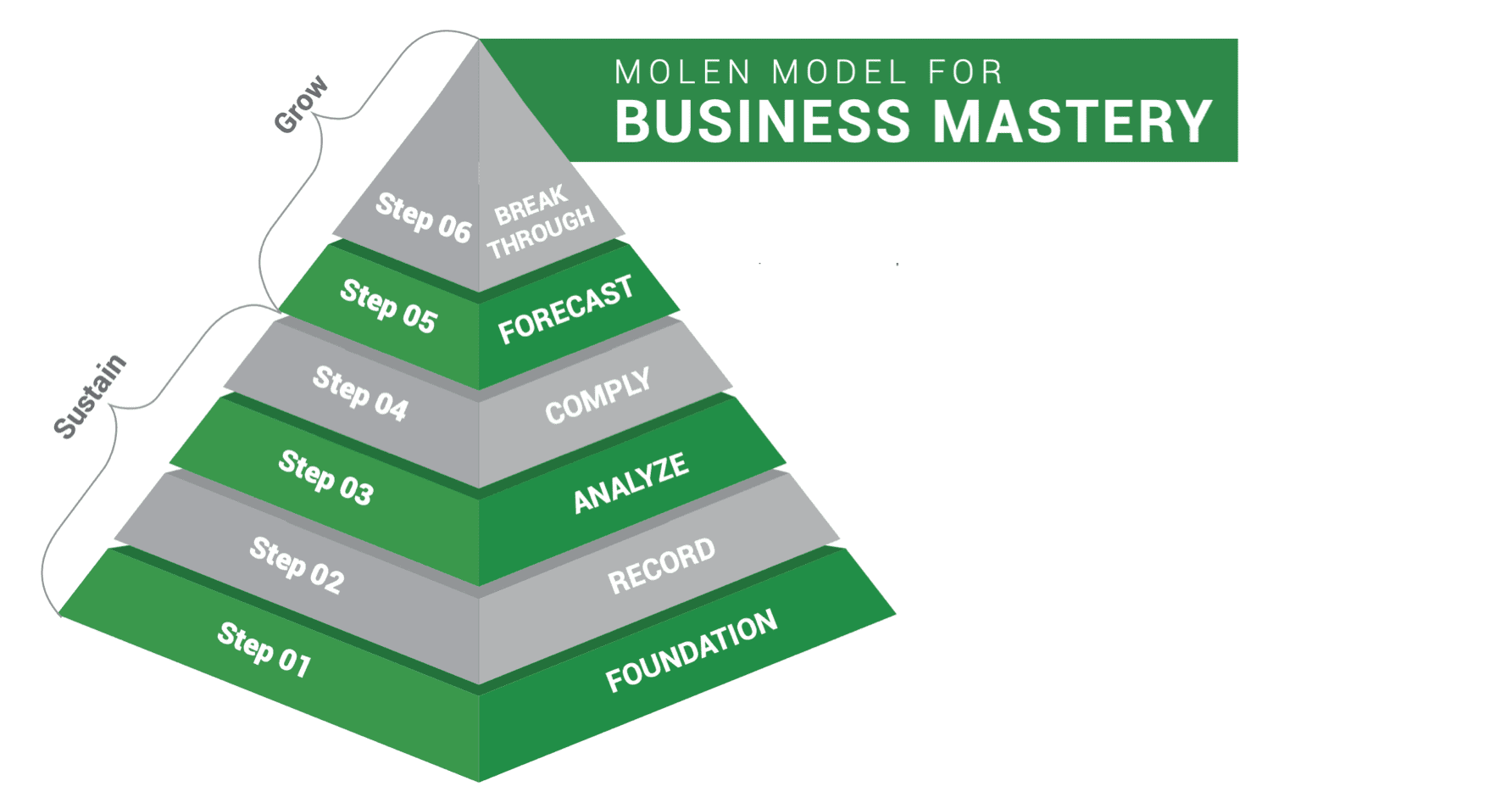

Stay Ahead of Law Changes & Protect Yourself Against Being Audited: Corporate Transparency Act and Reasonable Compensation

Proper Entity, Plan or Vision, Budget, Systems & Processes, Marketing, Accountability, Customer Service, Competitive Advantage

Our office will be closed from Friday, December 22nd, 2023 to Monday, January 1st, 2024.

Enjoy the festivities! We'll be back to unwrap the new year with you on January, 2nd!