The Importance of Your FICO Score Explained

Does my FICO score really matter? Why does it and what is it? The name FICO, originally Fair, Isaac and Company, is a data analytics company that focuses on credit scoring services. The company was founded back in 1956 by Bill Fair and Earl Isaac & FICO was created by the Fair Isaac Corporation in 1989. Your FICO score is a one kind of credit score and is the most recognized credit score.

A FICO score is a credit score that determines a consumer’s credit worthiness to borrow money. It does not necessarily gauge how well you manage money but lending institutions utilize this score a great deal. The FICO score indicates how well you repay consumer loans.

Is FICO the same as a credit score?

A FICO score is just one brand of credit score. Your credit score can be different depending on which scoring model is utilized. Some credit scores can vary by as much as 100 points. A friend of mine was purchasing a home and would monitor their credit score. They found it was nearly 80 points lower than their FICO score. Make sure you view all of your scores before you decide to buy a home.

A credit score provides lenders with a snapshot of a borrower’s credit risk. A high credit score tells the lender there is a low risk of the borrower defaulting on a line of credit or loan. On the other hand, a low credit score signals to the lender that it is a higher risk of a consumer defaulting on a loan.

FICO scores are the industry standard and 90% of top lenders for use it to determine a person’s credit risk. Lenders use this score to make decisions about credit approvals, interest rates and loan terms. A FICO score is trusted by lending institutions to be fair and accurate when they make lending decisions. The FICO also offers industry-specific scoring models (and scores) for distinct credit products such as auto loans, credit cards and mortgages.

What is considered to be a good FICO score?

The FICO score is made up of the following factors: Payment history (35%), Amount owed (30%) Length of credit history (15%), New credit (10%) and Credit mix (10%).

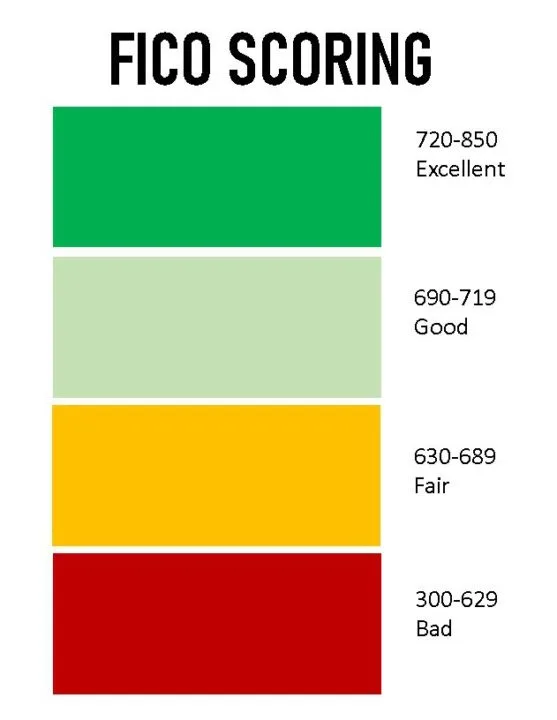

The Base FICO score uses a numerical range of 300 to 850. Lenders generally pull his number when a consumer applies for a credit card or loan.

The Industry-specific FICO score has a range of 250-900. Lenders also can be specific to an industry. As the name suggest, a mortgage company can look specifically at previous mortgage loans. This score can be different that an overall FICO score.

The UltraFICO provides an option for consumers to have their checking, savings, and money market accounts to be analyzed when determining credit worthiness. It is designed to aid individuals with lower credit scores. The UltraFICO score can raise your overall score by 20 points.

In each of these models, the higher the score indicates the lower the credit risk. The range of credit worthiness is as follows:

In general, most lending institutions consider a FICO score of 670 and above to be a good score.

Your credit scores can vary depending on which scoring model is used and which consumer credit bureau report — Equifax, Experian or TransUnion — the scoring model pulls your information from.

Who uses a FICO score?

The FICO score model is used by the vast majority of banks and creditor grantors. The FICO score’s algorithm is updated periodically to reflect more current lending trends and consumer behaviors. When you look for a new job, many potential employers may ask you to authorize a background check. Employers will ask perspective candidates to authorize a credit check as part of their screening process.

Your credit report is a journal of your financial history. It is most common to undergo a credit check as part of a job application if you are an aspiring manager or if you will deal with finances or confidential information. Employers use credit checks in the similar fashion as lending institutions. They are attempting to gauge your trustworthiness and aptitude when you manage money.

It is important to note that companies that run credit checks cannot see your FICO score. The report they receive includes information that contributes to your score, like payment history, and frequent late payments which could be a cause for concern.

How do I improve my score?

There are several ways you can improve your FICO score. First, you should fix the errors in your credit history. Obtain a copy of your credit report from all three major credit reporting agencies (Equifax, Experian, and TransUnion). Make sure you review the reports and contact your lending institutions and credit reporting agency to dispute inaccurate or missing information. This dispute should be in writing with documents that support your position. Your letter should clearly state the facts to prove that a discrepancy exists and request that it be removed or corrected.

The second way to improve your FICO score is to pay your bills on time. Did you know our payment history makes up 35% of your score calculation? Delinquent payments, missed payments, and collections can have a negative impact on your FICO score. Pay your bills on time because it will help to increase your score You should enroll in automatic payments through your bank and other credit providers when possible. The longer you pay your bills on time, the more your FICO score will improve.

What about debt?

Reducing the amount of debt you owe is the third option to increase your score. The balance of your debt to your available credit is called credit utilization. Your credit utilization contributes 30% to a FICO score calculation. You should strive to keep balances low on credit cards and other revolving credit. In addition, you should pay off debt rather than moving it around.

Open new lines of credit responsibly and pay them off on time. This will raise your FICO score in the long term. Also, if you haven’t, create a budget. I strongly suggest doing this so you can see where money is coming in and going out. Check here for 7 apps to help manage money and make your life easier.

How can I raise my FICO score in 30 days?

If time is a factor and you need ways to improve you FICO score in 30 days, consider these four tips. First you should correct any errors on your credit report. A creditor may have erroneously reported late payments, or there may be outdated information on the report. Contact creditors that report late payments, missing payment or defaults. You should ask that they correct the errors as quickly as possible and make sure to notify all credit bureaus.

Second, you should try to become an authorized user. By being an authorized user on an established account, the borrower’s available credit may rise, which in turn can lower their debt-to-income ratio. This may help to increase your FICO score quickly as long as the credit card or line of credit is current and has available credit.

Third, you should also request a higher credit limit. If you maintain a good payment history, a creditor may increase your available credit line. This will in turn could help boost a FICO score.

Finally, consumers can attempt to negotiate with creditors for debt in collections. A creditor may negotiate a balance that is in collection to mitigate further losses. In return, the debt in collection will be classified as paid.

In need of financial guidance?

If you have an interest in straightening out your financial situation then give Molen and Associates a call today. We offer finance consultations to help you maximize your earnings and find the right financial path for you.

Clarence Cooper

Operations Manager