Choosing Between 401K and IRA for Your Future

Most Americans will not be able to retire by the traditional retirement age of 65 even with an employer 401k plan or an IRA. Some plan on surviving solely off social security, but this was never meant to be a sustainable amount of income. The point of social security is to give a benefit at retirement that will help supplement taxpayers post-employment income. They are not supposed to provide their entire retirements funds. Most companies no longer offer pension plans, and instead offer employee paid retirement accounts.

It’s more incredibly important to plan for retirement as early as possible to avoid working yourself into an early grave. Do not get behind on your retirement planning because it is not going to plan itself. “Retirement is like a long vacation in Las Vegas. The goal is to enjoy it to the fullest, but not so fully that you run out of money” – Jonathan Clements.

Should I make Roth or Traditional contributions to my IRA or 401k retirement account?

This has been a question with much debate in the financial community. Why is this choice so difficult? The tax benefit for contributing to an IRA and/or 401K depends on your independent tax situation. This is why your strategy should be very different from a top earner like Jeff Bezos! It’s important to review the numerous factors that can help you determine the best account for your retirement. Find out which type will save the most in taxes and what would be the better investment for you.

To make an educated decision for your future, you’ll need to understand what an employer 401k plan is versus’s IRA. Find out the difference between pre-tax and post-tax contributions and the rules regarding these types of retirement accounts.

What is a 401k?

Employer pension plans are largely a thing of the past. In the 1980’s companies started to cut costs associated with expensive pension plans in favor of the 401k account. An employer 401k is a benefit offered to employees. They are heavily based off of elective salary deferrals that puts off receiving the income and paying taxes on it. Most of the burden lies on the employee to contribute to their 401K account. However, many employers use these accounts as a tool to keep top talent by “matching contributions”. This means that the employer is putting free money in your account. You will lose this money if you do not stay for ‘X’ amount of years.

For 2020, an employee can defer up to $19,500, and an additional $6,500 for those 50 and older. Whatever you put away now will gain interest and dividends which will be used to buy more stocks and bonds. This strategy of compounding interest is the key to any long-term savings.

What is an IRA?

In contrast, an IRA can be set up by anyone with some money to put away. These accounts lack the benefit of having employer contributions. They do offer a wide range of providers and investment styles to choose from.They may be limited to your Adjusted Gross Income. Most of these companies offer robo-investors that manage your long-term investments for a small percentage of your earnings.

Similar to an employer plan, you don’t have to pay taxes on these earnings unless you take money early. Another disadvantage for these types of retirement accounts are their smaller yearly contribution limits. In 2020 you can contribute $6,000 or up to $7,000 if you are age 50 or older. Keep in mind that these retirement contributions are limited to your taxable income for the year.

What are the benefits of pre-tax contributions?

Pre-tax accounts, like a traditional IRA, 401k and deferred comp accounts, have the benefit of being excluded from taxable income. This means that if you put away $1,000 into a pre-tax account such as an employer 401k, and your highest tax bracket is 22% than you will have saved $220 in taxes for the year!

As your investment grows over time, you do not have to pay income taxes on earnings from interest, dividends, and gains on reinvested stocks. The best strategy is to avoid taking money from this account until you are 65, or otherwise qualify to avoid penalties. For more information on what qualifies a retirement distribution, and what causes penalties check out this blog https://molentax.com/the-high-price-of-a-401k-withdrawal/.

Since the money in pre-tax accounts was deducted from income in prior years, it is added as income in the year that you take a distribution. If you are offered a pre-tax retirement account from your employer, it is important that you contribute enough to max out any employer matching that is offered. Even if you are not offered an employer plan, you should start up a traditional IRA if you expect that your income now will be higher than when you take out the funds. Since most people earn more during their working years, pre-tax accounts offer the best form of tax savings if you expect this to be your situation.

What are the benefits of post-tax contributions?

Post-tax accounts such as a Roth IRA or Roth 401k do not offer immediate tax savings. Instead they are tax free when pulled out at retirement. For example: let’s say you put away $1,000 into a post-tax account such as a Roth 401k. Your highest tax bracket is 22% so these contributions are still included in your income. They will create $220 of taxes for the current year. Like pre-tax accounts, you can avoid paying income taxes on earnings from interest, dividends, and gains and reinvested stocks.

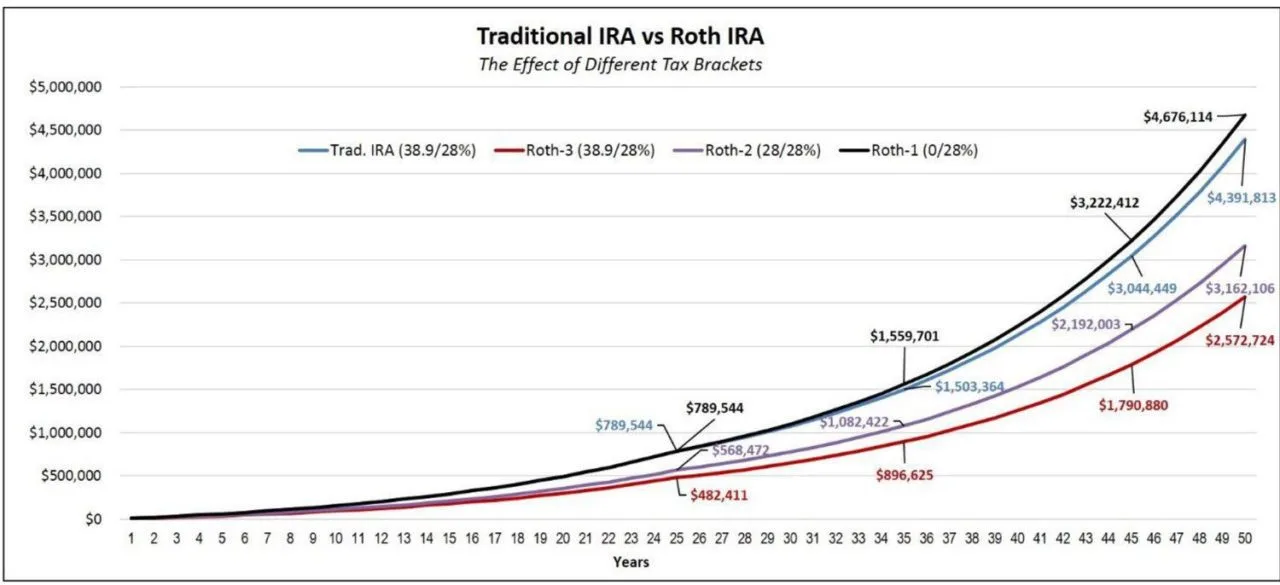

You should avoid taking money from these accounts until retirement to get the most benefit from your savings. The key benefit of post-tax accounts is that your contributions have already been taxed. Your entire account earnings included will be tax free. If you’re income is high but you expect to have less income at retirement then consider a pre-tax account. What if you expect to make as much or more income at retirement? The Roth has the advantage of avoiding all taxes on earnings even when distributed. Here are recent changes for 2019 https://molentax.com/covid-19-ira-information/.

What account gives me the best tax advantage?

Generally, retirement accounts of any type are considered ill-liquid assets that shouldn’t be touched for a long period of time. The benefit you get from any type of account depends on your taxable income. Your current and expected future taxable income should be considered when deciding what your retirement strategy is. Give us a call to speak with our wealth management advisor whom you can trust to plan a successful retirement.

Austin Long

Tax Advisor