My wife and I recently saw The Rise of Skywalker and while I had mixed feelings about the film, it’s still fun to watch new Star Wars content, but I digress. To segue into our topic, the financial markets across our globe are full of differing types of securities and investment products. Today I want to talk a little about bonds from a tax advisor’s perspective.

A bond is a written guarantee

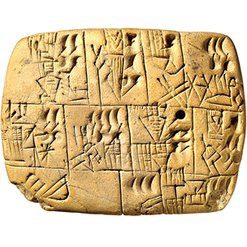

The first bond ever recorded was found etched into a stone in Mesopotamia, dating to about 2400 B.C. It guaranteed the payment of grain.

Fast forward to 1917, during World War I, and the very first Liberty bond, also known as a defense bond, was issued by the United States government. By selling these bonds the government raised over $16 billion for its war efforts. The interest rate, or the term a financial advisor might use, the “coupon rate”, was between 3.5% and 4.25%.

The modern idea of a bond is that you pay face value for it now, let’s call it $1,000, and it has a maturity date 15 years from now. During that 15-year period you receive regular interest payments for owning the bond. At any point you may sell that bond to another investor and they will begin receiving the interest payments for the bond. You may also choose to keep the bond until maturity, at which point you sell the bond back for its maturity price, often equal to your original purchase price. A bond’s value, or “yield”, varies based on prime lending and other interest rates at the time. As interest rates fall bond prices rise, since their coupon rates are mostly static.

An example of this is ABC Bond issued by 123 Company. It’s being sold for $1,000 with a maturity date of 2035 and its coupon rate is 4%. You purchase one ABC Bond and hold it while enjoying the 4% interest you receive annually. However, by 2025 interest rates have dropped dramatically, prime lending went from 5.5% when you purchased the bond down to 2% in 2025. Suddenly everyone is clamoring to purchase your ABC Bond because the 4% coupon rate is so attractive.

In the example above you may choose to keep the attractive interest rate for yourself or sell the bond above your purchase price which could net you a nice gain. Keep in mind of course that there are tax implications for the sale of the bond above your purchase price.

It’s not hitting the ball out of the park, but it’s a base hit

Most portfolios include some amount of bonds alongside other securities like stocks. Generally, bonds are considered to be guarantees in an industry where very few guarantees exist. Many 401(k)’s these days have age-based retirement funds, and while they’re not always the best option you have available to you, they will help me get my next point across. The way they work is you pick a year that you plan to retire and invest in that single fund (all eggs, one basket, see what I mean?). The fund itself evolves over time and the closer you get to retirement, the more the fund sells stocks and buys bonds. The idea is that while stocks have more potential for growth, they also include more risk and volatility. The one thing you can’t afford the year before you retire is significant volatility in your retirement account.

This is to illustrate the give and take between stocks and bonds. Even young investors, who can afford significant risk and volatility in their accounts, will include some small measure of bonds. The consistent smaller gains can help hedge against things like account fees.

It’s important to note that bonds, and securities in general, shouldn’t be boiled down to simple explanations only as the modern-day markets have sophisticated instruments for investing purposes. While I’ve given an explanation and attached an example, this doesn’t cover the vast intricacies that this topic deserves.

Should you be interested in seeing how bonds can help stabilize your portfolio, speak with a licensed securities professional such as a financial advisor. One such professional, Brandy Ariza, a Certified Financial Planner, works within our offices and is available alongside our tax advisors. If you’re interested in the investment and tax implications of your retirement, you should call us at Molen & Associates, where we pair the two together by giving you access to an expert in each field. You’ll sit down in a room with both a tax and financial expert who work together to achieve your financial goals.

Kevin Molen

Tax Advisory Manager