Protect Your Finances: Avoiding the Economic Virus

While it may not seem like it at first, I promise this won’t be another news article to drive more hysteria. There is already plenty of that going around. It also won’t be a regurgitation of the CDC advice on how to stop the virus from spreading. Coronavirus not only can impact your health, but also your wallet. At Molen & Associates, we like to focus on what we are good at. We are passionate about unraveling tax headaches and building financial vision. If you have recently checked your 401(k), you may be thinking, “I need some financial vision right now…” In my own finances, I always come back to Warren Buffett’s quote, “Be greedy when others are fearful”. If this has ever been true, I believe it is true now.

As everyone has seen in the media, the coronavirus continues to spread, leaving major conferences, events and festivals being canceled or postponed around the globe. From China to California, the economic effects are already starting to show, and cancellations are threatening many different businesses and economies.

The Economic Impact of the Coronavirus in Houston

There are dozens, if not hundreds of events that have been cancelled in Houston, TX and even more nationwide. South by Southwest in Austin, the Houston Livestock Show and Rodeo as well as extended college spring breaks and other school closures are all major financial hits to the individuals, businesses and local economies participating. However, it is still unknown how the effects of the coronavirus will impact individual Texans.

As quoted in the Texas Tribune, Billy Benedict, owner of J&J Spirits in east Austin, said he relies on a big boost from the South by Southwest crowds every year. So does the city: The 2019 festival’s impact on the Austin economy reached $356 million, according to the consulting agency Greyhill Advisors. In March 2019, festival attendees booked more than 55,300 hotel room nights, generating $1.9 million in city hotel taxes for the month, according to Greyhill.

The Houston area is currently the state’s hardest-hit region. The majority of people are pulling back from all types of events and reducing the number of outings to avoid possible contamination. This reduces the number of dollars spent in the local economy. Even the government agencies that rely on the sales tax from these types of events will be hurting. Until people begin to feel comfortable with the direction of the coronavirus, many will be reluctant to spend discretionary funds.

Stock Market Implications of the Coronavirus

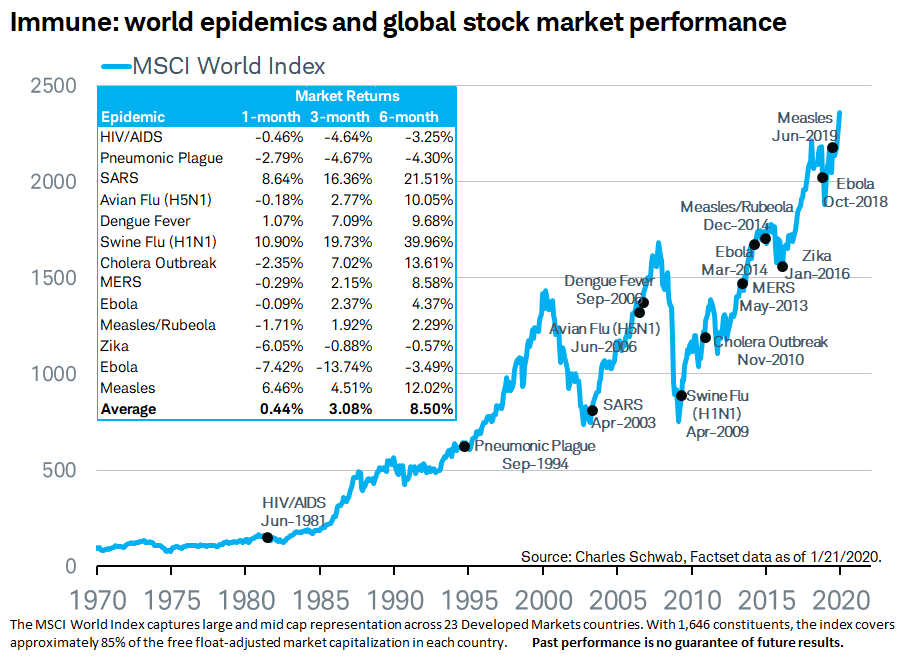

The stock market as a whole has been on a steady climb of the last several months. Some may argue that the market was inflated due to a few large tech stocks and was due for a readjustment. The news of the virus creates a perfect storm and encourages some investors to sell on bad news such as this. Early on, the impact of the coronavirus was comparable to the SARS outbreak of 2003, but now a few weeks later, the stock market continues to drop. The longer-term effects on markets will be determined by how many cities or countries are shut down and are unable to operate. It is no doubt that the impact will be significant.

It would be nice to think that the economy of advanced countries like the United States are immune to these effects, but the opposite is probably the case. We have many service industries in the United States. When populations turn to fear, they withdraw from one another and stop going to school, stop traveling, stop going to sporting events, the gym and even the dentist. While grocery store sales are up, restaurant sales are down.

Right now the “homebody economy” is booming! On-demand streaming services, online shopping, food delivery, online education, and working from home have all increased with the outbreak. Previously, these were services mainly used by the millennial generation. Now, the growing concerns around public contact and contagion are causing the masses to adopt newer technologies.

Federal Reserve Cuts Due to the Coronavirus

The Federal Reserve or “the Fed”, which is the central bank of the U.S. has made emergency rate cuts in response to the economic concerns. One of their primary duties from Congress is to maintain the economic and financial stability of the country. So, why did they lower interest rates? The logic goes like this: When the economy slows – or merely even looks like it could – the Fed may choose to lower interest rates. This action incentivizes businesses to invest and hire more, and it encourages consumers to spend more freely, helping to propel growth. On the contrary, when the economy looks like it may be growing too fast, the Fed may decide to hike rates, causing employers and consumers to tap the brakes on their financial decisions.

Because of the recent rate cuts, the Fed is trying to stimulate the economy before things got too bad. These rate cuts normally affect interest rates across the board: credit card rates, savings & CD rates, mortgages, student loans and even auto loans. Because the effects of this decision are so complex, here is some advice to deal with changing rates.

“Look at your overall financial situation against the backdrop of what’s happening with rates. [The] list of ways the Fed interest rate affects [you] might be different than someone else’s. Ask yourself how you can take advantage of rising or falling rates for maximum financial benefit when it comes to your borrowing, saving and spending priorities. For example, if the Fed hikes rates and you’ve been building up a college savings fund for your children, you may be motivated to put more into savings to take advantage of higher returns. If rates are cut and you’ve been in the market for a loan for some time, now could be the time to jump on it.”

In short, if you had plans to buy a house, car or even start a business – now is a great time to do so with the interest rates being so low.

Tax Implications of the Coronavirus

President Trump has recently instructed the Treasury Department to allow individuals and businesses negatively affected by the coronavirus to defer their tax payments beyond the April 15 filing deadline. While this change is not yet final, it would have the effect of putting more than $200 billion back into the economy. Yes, that is billion with a “B”. We still do not know when the deadline would change to or who this change would apply to, but this would be another economic stimulus very similar to the lowering of interest rates. Both decisions would ultimately put more money back into the economy and encourage spending. In a normal tax season, taxpayers can file an extension for the filing of their tax return. This extension allows the taxpayer to defer the filing of the tax return, but still requires that the taxes due are paid by April 15th. The AICPA issued a press release AICPA Calls for Individual & Business Tax Relief Amid Coronavirus Pandemic, dated March 11, 2020.

The AICPA letter recommended an automatic extension for all taxpayers, without having to submit form 4868. The AICPA also suggested reducing the 90% payment rule to 70%, figuring the IRS might then provide the relief to all taxpayers. The AICPA letter further recommends: “Waive interest through October 15, 2020; and waive underpayment penalties for 2020 estimated tax payments if paid by September 15, 2020.” See the letter for their other recommendations.

Small Business Help with Coronavirus

During this same time, the president announced that he would instruct the Small Business Administration of SBA to provide low-interest loans for businesses in the U.S. that have been affected by the virus. These loans would help overcome the economic disruptions caused by the virus and help overcome the supply chain ripple effects that will surely show as we face the coronavirus for longer periods of time. There was also a large variety of other options that were discussed including: quick tax cuts and tax holidays, government financed paid sick leave, and targeted bailouts for industries hit especially hard such as airlines and cruise ship operators.

The payroll tax holiday was one particularly popular in the media. A payroll tax holiday is basically a suspension of payroll taxes. While this means more dollars in take home pay for employees, these funds need to come from somewhere and would likely add to the federal debt. The SBA has published an article with a list of the resources they are now providing to small businesses.

In Conclusion

As I’m sure you are seeing now, all of these government aids are directed at one thing: putting more money in our pockets so we can spend it and boost up the economy to pull through uncertain times.

Hopefully the upcoming week(s) will provide more clarity on how our economy will play out and the impact that this will have on our personal finances. There is a lot of fragility in this market, and I don’t recommend trying to time the market – but there are still opportunities to be had. If you had a plan for your finances before the coronavirus, this isn’t necessarily the time to change that plan. If you need help with your finances or building this plan – come visit us or give us a call. We would love to help you navigate these uncertain times. Now, go wash your hands for the full 20 seconds!

Chief Operating Officer