Ways to Assess Your Home’s Investment Value

June 8, 2022, my husband, and I made the largest purchase of our lives. We purchased our first home. Of course, there were many discussions about where we wanted our house to be located, the cost and what this means for us long term. The most exciting thing about when we were looking for our house, was that there was going to be a larger development that was to be built next door that would raise the value of our home over the next few years. Of course, the housing market has been up and down over the last few years, but listen when I tell you, purchasing a home can be one of the best investments that you will make. Now with every decision you make in life, there are pros and cons. Why don’t we look into both.

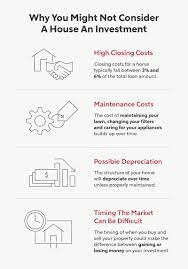

Depending on the time you purchase your home, what the interest rates are, there are many debates on whether buying a home is a good investment. Say you were to purchase a home for $200,000 with an interest rate of 5.75%. This is starting out to be a great investment. However, once you finally get into your house, you see all the repairs that are needed. You may need to replace a hot water heater, or an air conditioner unit. When purchasing a home, these are some of the additional costs that you need to be aware of, as they can cause you to need to put up a lot of additional funds up front. However, by doing so, there is a plus side to this. In replacing older equipment, you can raise the value of your home, therefore increasing the investment that you have made.

According to Rocket Mortgage, there are many advantages to owning your own home as opposed to renting. One benefit is that when you rent, your money is just going to a landlord. They will then have control of this money. When you own your home, you are putting the money back into the equity of your home. Another amazing benefit to owning a home that will make this a good investment is the tax benefits. If you itemize your deductions, you can deduct mortgage interest and property tax payments on your taxes every year. That said, you should only itemize your tax deductions if it makes sense financially.

For reference, according to the Internal Revenue Service (IRS), here are the standard tax deductions for tax year 2022:

- Head of household: $19,400

- Single taxpayers and married individuals filing separately: $12,950

- Married couples filing jointly: $25,900

It is also noted that homeowners have better financial stability. According to a 2020 survey, homeowners tend to have a net worth of $255,000, which is more than 40x those who are renting. Let’s also think about if you decide to sell your home. As we said before, the housing market is very fickle and can change without much notice, however, should you keep up on proper home maintenance, and you go to sell your home after living there for 10 – 15 years, there is a strong possibility that you will make a great return on your previous investment. The $200,000 home you purchased could now be worth $450,000.

Now that we have looked at some of the pros of your home being a good investment, let’s take a look at some of the cons. One major con is potential depreciation. Not all homes are going to grow in value. If you remember back in 2008, we hit a horrible recession, which caused many home buyers unable to keep up with their mortgages and lost their homes. We never know when something like that could happen again, so when you are making the decision to purchase a home, keep in the back of your mind that this can be an outcome you were not expecting. Also, just like your car, your home will depreciate over time. It is best to keep up with the maintenance of your home, which also can be pricy.

There is also a possibility that you will have high closing costs when you are purchasing your home. Make sure that you are fully aware of what is needed when you are going to purchase your home. Depending on your loan that you are approved for, make sure that you have the down payment (which can be up to 20% of the full cost of the house), title costs, closing costs, and any additional costs that may come with the purchase of the home. Some of the most common closing costs include an application fee, appraisal fee, attorney fees, property taxes, mortgage insurance, home inspection, first-year homeowner’s insurance premium, title search, title insurance, points (prepaid interest), origination fee, recording fees, and survey fee. Experts say you should plan to stay in your house for at least five years to recover those costs.

Investopedia.com also discusses the pride that comes with owning your own home. You are able to customize your home to your liking without getting permission from a landlord, or an apartment management company. There are also responsibilities when you purchase your home. You must pay your mortgage or risk losing your home. Maintenance is all your responsibility. You can’t call the landlord at 2:00 a.m. to have a leaky water pipe repaired. If the roof is damaged, you must repair it—or have it repaired—yourself. Lawn mowing, snow removal, homeowners’ insurance, and liability insurance all fall on you.

In conclusion, you can look at either options on whether your home is a good investment or not. When you look at the larger picture of everything, I would say yes. You are not only making an investment in yourself, but you are also making an investment for your family. You have a place to live that you can make your own with furniture, painting a room the color you like, and you are able to make memories with your family and friends. While I was scared about purchasing my home, I realized that this was the best option for my family and I cannot wait to see how my investment that we made becomes better and what the value of our home will be in 10-20 years from now.