Our Process

What to Expect When You Work With Molen & Associates

Jump to a Section

Use the links below to jump to the service you’re interested in

New Client at M&A

Tax Preparation Process

Bookkeeping Process

S Corporation Setup

Consultations & Tax Planning

IRS Letters & Audits

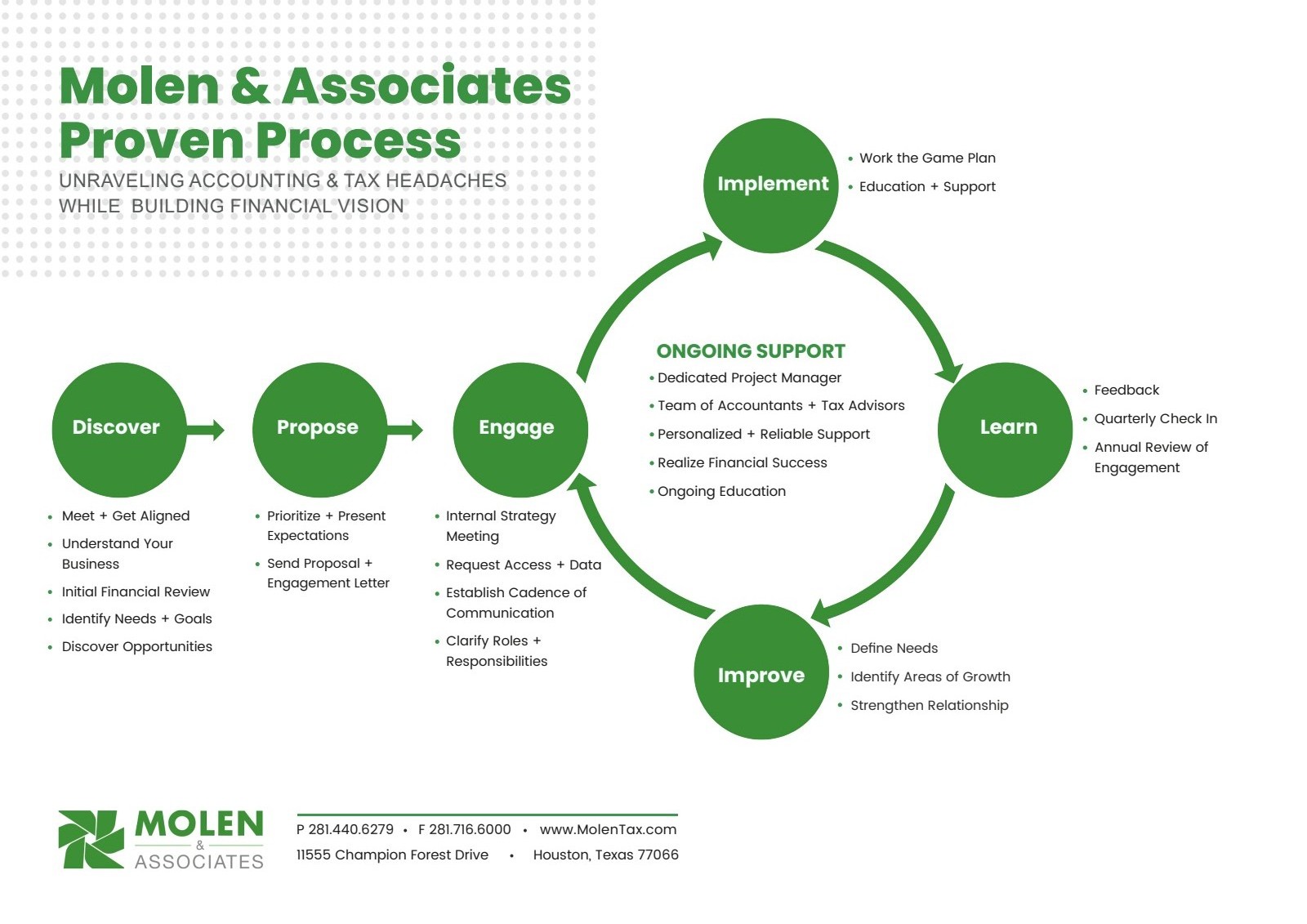

Initial Steps for Every Client

No matter what service you need, here’s what your journey starts with

Discovery Meeting

We start by getting to know you and your business. For business owners, we generally spend between 30 minutes and 1-hour learning about you, your business as well as the tax & accounting needs you have. For individuals, we schedule a 15 minute discovery call with a tax advisor to see if we are a good fit. In these meetings, we’ll ask questions, listen to your needs, and explore the best service options for you.

Access & Information Collection

Once we know what you need, we’ll request access to your accounting software (if applicable), financial documents, prior-year tax returns, or any missing information.

Quote & Service Options

After reviewing your situation, we’ll send you a customized quote, outlining options for transactional a la carte services (pay as you go) or monthly subscription packages (available for qualifying clients). You’ll choose the path that works best for you.

Engagement & Onboarding

Once you engage us, we will get started on working the game plan! We’ll send over your engagement letter and set up your client portal access. Once signed and confirmed, we’re ready to go! On the subscription route, you will be assigned a dedicated project manager who will check in with you quarterly.

45+

10,000+

98%

1000s

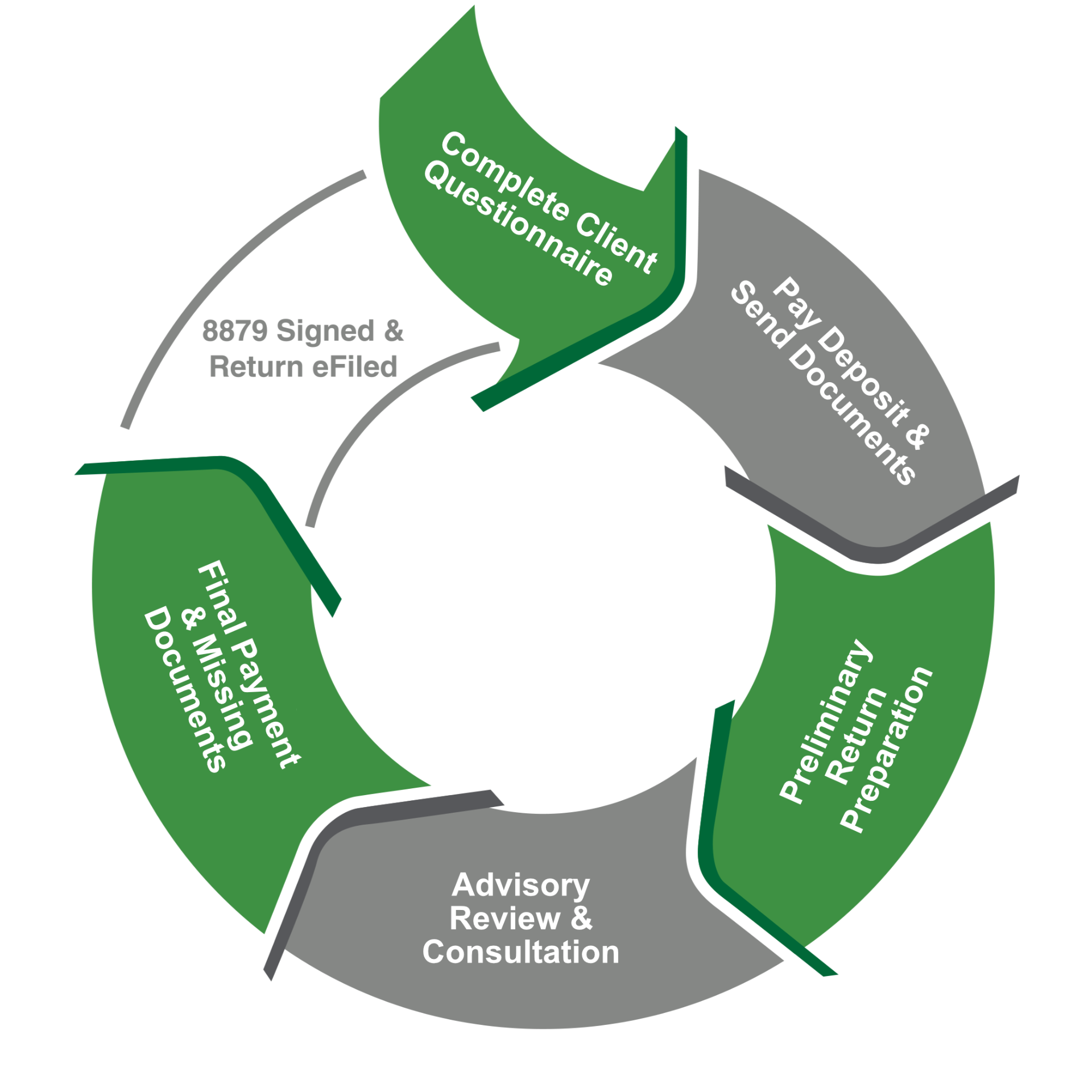

Tax Preparation Process

Whether you’re self-employed, a W-2 employee, or a business owner — we prepare taxes with one goal in mind: accuracy with maximum deductions, while helping you understand the “why” behind the numbers.

Document Collection

We always request an engagement letter, questionnaire, initial deposit and your tax documents before we begin. This ensures we have everything needed to prepare 90% of the return and not waste your time. HERE is a video that shows you how to send us all needed forms and documents.

Data Entry

We review the documents you have provided and enter everything to begin the initial steps on your tax return. After the tax advisor has done the initial data entry, it goes to a Quality Assurance staff member to review the data entry to catch any numbers that may have been mistyped.

Advisor Review

The return then comes back to our tax team for a 2nd review. In this review, they ensure they have all items needed, compile a list of questions to ask you, details or documents that are still needed and ensure the return is ready to discuss.

Interview Appointment

You’ll meet with a tax advisor — either virtually or in person — so we can understand your full tax picture. In this meeting, we’ll go over the outcome of the tax return, ask for any additional items needed to finalize the return and you even have the opportunity to ask questions about potential deductions or ways to plan for the future.

Payment & Delivery

After the advisor has made any final changes, you will receive an invoice for the final amount due. When this is paid, the return will be sent to you via Docusign or over the Portal to review. If you have any questions or concerns, feel free to let us know and we’d be happy to clarify or make adjustments as appropriate.

Signature & eFile

When you are ready to move forward, you will then sign form 8879 and any additional forms needed and we will eFile your return. It can take a day or two for the IRS to accept the return. At this time we send you a confirmation via email, and the return is normally processed by the IRS in 2-3 weeks.

Year-Round Support

Our team is here for you long after tax season — reach out any time with questions, IRS notices, or planning needs.

Ask About Our Client Care Package (CCP)

When we prepare your tax return, you have the ability to enroll in our Client Care Package — a form of audit protection that gives you peace of mind all year. If you ever receive an IRS or state notice related to the return we prepared, we’ll handle it for you — including direct communication with the IRS if needed.

Bookkeeping Process

Catch-Up Bookkeeping

Behind on your books? Don’t worry — we specialize in catch-up and cleanup projects.

Our Catch-Up Approach:

1. Initial Assessment

We evaluate how far behind things are and estimate the work needed.

2. Custom Plan

We’ll obtain Accountants access to your QBO account (or the software you are using) and we will take 24-48 hours to get an estimate together.

3. Clean-Up Execution

We fix miscategorized transactions, reconcile old statements, and bring your books up to date. After we are done, a tax advisor or senior accountant reviews the books to ensure your records are ready for tax filing.

4. Optional Ongoing Service

If desired, we’ll transition you into an ongoing bookkeeping subscription.

Ongoing Bookkeeping

Perfect for businesses that want accurate books and peace of mind all year.

What It Includes:

- Income & expense transaction categorization

- Bank & credit card reconciliations

- Ensure asset, liability and equity accounts are all handled correctly

- Financial statements delivered monthly or quarterly

- Annual tax-ready financials

How It Works:

1. QBO Setup/Access

We connect or create your QuickBooks Online account.

2. Automation & Rules

We’ll walk you through the process of connecting your bank feeds to your account so we can handle the categorization.

3. Monthly Maintenance

You will provide bank, loan and credit card statements and we reconcile these accounts to ensure your numbers are clean.

4. Advisory Support

Each quarter, your books are reviewed by a tax advisor or senior accountant to ensure the bookkeeping stays on track and compliant.

Take some work off your plate, leave the numbers to us!

S Corporation Setup

Thinking about becoming an S Corporation? We’ll guide you through every step.

Our S-Corp Process Includes:

Entity Review & Consultation

We help determine if S-Corp status is right for you. We’ll even run through the numbers and teach you how the taxes work as a 1040 Schedule C vs. S-Corp.

Reasonable Compensation Planning

We conduct an interview to learn what roles you provide to your company and process this data through software that pulls in local pay rates to provide a Reasonable Compensation Report.

2553 Filing

We prepare and file Form 2553 to elect S-Corp status.

S-Corp Acceptance

The IRS can take a while to process. If it takes longer than 6 weeks to receive an acceptance, you will need to contact the IRS to request an update.

Payroll Setup

We assist with payroll service setup and integration, ensuring withholdings are properly set up so it can be ‘set it, and forget it’.

Consultations & Tax Planning

We offer tax planning and educational consultations a la carte, or on a quarterly basis as part of most subscriptions. More than just compliance — we help you plan and thrive.

Popular Topics We Cover:

- Quarterly tax planning for small businesses

- Entity structure reviews

- Retirement contribution strategies

-

Year-end planning sessions

-

Income shifting & deduction maximization

-

IRS letters and notices

IRS Letters & Audits

We handle the scary stuff so you don’t have to.

Getting a letter from the IRS can feel overwhelming — but don’t panic. In many cases, it’s a simple notice that can be easily resolved. And when it’s something more serious, our team is trained and experienced in helping clients navigate audits, payment plans, and IRS correspondence with clarity and confidence.

What We Help With:

IRS and state tax letters

CP2000 & underreporting notices

Audits and exams

Liens, levies, and garnishments

Back taxes and unfiled returns

Payment plans and offers in compromise

Innocent spouse relief

Penalty abatement requests

Our Process:

Review the Notice

Send us a copy of the letter through your secure client portal. We’ll assess the issue, check your records, and determine the next steps.

Advisor Response Plan

A tax professional will review your situation and prepare a plan of action. This may include amending returns, calling the IRS on your behalf, or preparing a written response.

Client Communication

We’ll walk you through the notice, explain what it means, and what we can do to help. You won’t be left guessing — we’re with you every step of the way.

Resolution & Follow-Up

Once the response is submitted, we track the progress with the IRS and follow up until it’s resolved. We’ll advocate for the best resolution possible.

Ready to Take Control of Your Finances?

Schedule a discovery call with our team. Let’s discuss how we can help you save time, reduce taxes, and grow your business with confidence.

Get In Touch

We’re here to answer your questions year-round, not just at tax time.

Phone

Serving

Office Hours

Monday – Wednesday: 9:00 AM – 5:00 PM

Thursday: 9:00 AM – 8:00 PM

Friday – Sunday: Closed

Extended hours available during tax season

Send Us a Message

Fill out the form below and we’ll respond as soon as possible.