Young Adults and Money: Building a Brighter Future

As someone who has been working for most of their life, I wish there was someone out there who had shown me the correct way to save money for my future. Now that I am in my 30s, I have been getting better at saving money, but there are some personal finance tips that I am looking at now, that I wish I’d known earlier so I could have put them into practice sooner.

The best time to start thinking about your savings is right when you are getting to graduate college and start your career. If you decide not to go to college, once you get a job, you should think about your savings for the future. There are many big purchases in the future that a young person must consider: savings, such as, weddings, children, purchasing a home and retirement.

According to WCNC Charlotte, here are 5 money saving tips that all young people should consider to have healthy personal finances.

- Social Security Number is sacred

- Don’t just buy the brand, buy the stock

- Start investing as soon as possible

- Save 20-30% of your paycheck

- Have a plan to reset debt

Now let’s dig into these deeper.

Social Security Number is Sacred

When you are born, you are assigned a social security number from the government. This number is used for many things throughout your life. Your credit is also tied to your social security number. You want to make sure that no one ever gets access to your social security number. If you want to get credit cards, a car, a house, they will pull your credit score from your social security number. If anyone gets access to your social security number, they can use this information to open accounts that you did not give permission to. In order to protect yourself, make sure you are not giving out your social security number to everyone, only provide it when absolutely necessary.

Don’t just buy the brand, buy the stock

Every time you buy a brand name, you give free advertising to that company. Wouldn’t you like to see some of that money come back to you? Think of looking into purchasing stocks with the most popular brands: Nike, Apple, Disney. If you ever decided to sell your shares, you will get some money back. At least now when you use/wear that brand, you can do so knowing that you are making some money while doing so.

Start Investing as soon as possible

A common myth is that you need to have a lot of money to start investing. This is not true. You can start an investment with as little as $1. Look into robinhood.com and you can see all that you invest into. A good thing to remember is that stocks can go up and down, make sure that if you are going to invest in stocks, that you have someone that can assist you should you have any questions.

Save 20-30% of your paycheck

You want to build a savings account for anything that you may need in the future. Some personal finance experts say that you want to build a savings of about 6 months to ensure that if you were to lose your job, or run into serious health issues, you are still able to pay bills and survive since you have your savings to fall back on. You also want to consider building the savings for the larger purchases that you plan on making in the future. You can save for a car, a house, your wedding, future children, their education, and even your own retirement. When you go to the bank to open your checking account, you should also open a savings account. The best way to make sure that you have the money going into your savings is when you are setting up your payroll at your job, you request a certain amount of money to go directly into your savings account. You can also look into a High Yield Savings account that will continue to grow for you as you add money to the account.

Have a plan to repay debts

If you had to take loans out for college, you want to make sure that you can pay back the loans in a timely manner. You want to make sure that you can find a job where you are able to set some money aside to make the payments for the loans that you borrowed. You also want to keep in mind that you do not want to borrow any additional money until you have paid back at least half of the amount of the loans that you needed to borrow. In doing so, this will also help your credit, which again, is tied to your social security number.

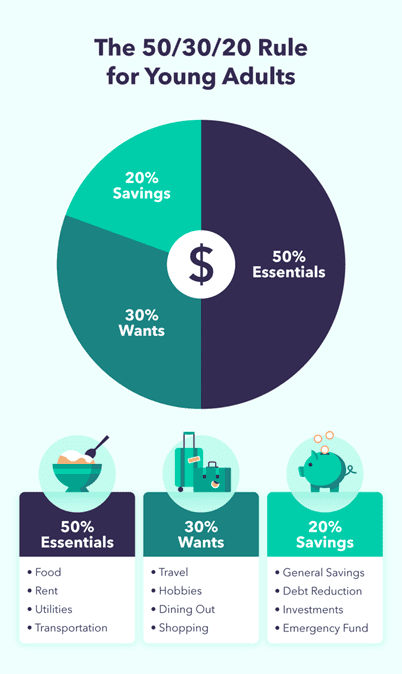

Now let’s talk about budgeting. Budgeting is something that I struggled with in my 20s, but I am now making sure that I discuss my budget with my husband, and we try our hardest to stick to it. I recently read an article on mint.com which gave many additional tips on budgeting and money management, but there is one thing that stood out to me that I wanted to discuss further. That is the 50/30/20 rule. This is something that I am slowly adapting to in my personal life, and I think this is a great tip for a young person.

What is the 50/30/20 Rule?

To put it in simple terms: 50% of your income will go to essentials, such as bills/expenses that need to be paid each month (housing, car, food, etc.). 30% of your income can be used towards your wants that month (coffee runs, date nights, etc.). The remaining 20% of your income should be put into savings. This will help build that savings account that we discussed earlier and you will be able to use the money as needed for emergencies.

How to learn about Personal Finance

Should you have any additional questions on building your savings and how to complete your taxes, especially if you just got your first job, please give us a call at 281-440-6279 and someone from our office would be more than happy to assist you with any questions you may have.