Should I Open An HSA Account?

Are you considering a Health Savings Account (HSA)? If so, it is vital to understand what exactly an HSA entails. With this guide, you’ll learn all about it: the advantages of an HSA and how it can help you manage your medical expenses. An HSA is a great way to save on taxes, build up a fund for medical expenses, and even invest for retirement.

Read on to learn if you should open an HSA account and how an HSA can benefit you.

What is an HSA?

A Health Savings Account (HSA) is a type of personal savings account that is exclusively designated for medical expenses. Those eligible can set aside tax-deferred funds to be used for healthcare costs.

When you open an HSA account, you fully control the funds. You can request a debit card (or checks) that can be used to cover eligible healthcare costs such as prescription medications and medical tests.

The money is held by a financial institution (such as a bank or credit union) until you need them to pay for qualified healthcare expenses. Your employer can also contribute to your HSA, allowing you to accumulate additional funds. However, they do not manage the funds. And you remain the account owner, and changing jobs won’t take the money away.

Who Is Eligible For An HSA?

Eligibility for an HSA depends on the type of health insurance plan that an individual has. To qualify for an HSA, an individual must:

· Have a high deductible health plan (HDHP): HDHPs have lower monthly premiums and higher deductibles than other health insurance plans. For 2023, HDHPs are classified according to a minimum deductible of $1,500 for single coverage and $3,000 for families. The maximum expense for an individual will increase to $7,500, while the maximum out-of-pocket costs for a family will rise to $15,000.

· Not be enrolled in any other health plan: This includes Medicare, Medicaid, TRICARE, and most other government-sponsored health plans

· Not claimed as a dependent on someone else’s tax return

· Not having any other type of health coverage: The HDHP is the sole source of health insurance coverage and does not include any supplemental insurance policies from a spouse or other family member, such as those for vision, dental, long-term care, or disability benefits.

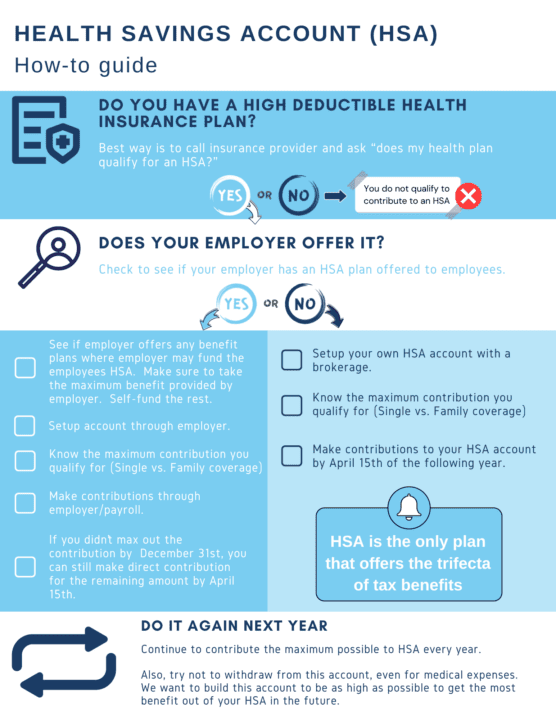

If your plan meets the criteria, you can set up an HSA. Your employer may have one available to you. But if they don’t, you can easily open an account at most banks and financial institutions.

Make sure you look for plans tagged specifically as “HSA-eligible.” Be aware that some plans may have high deductibles but do not qualify for an HSA.

Why do I need an HSA? Is it required?

Health Savings Account is not required. But it is a great option for anyone with a high-deductible health plan who wants to save for healthcare expenses. Here are some important HSA benefits to consider.

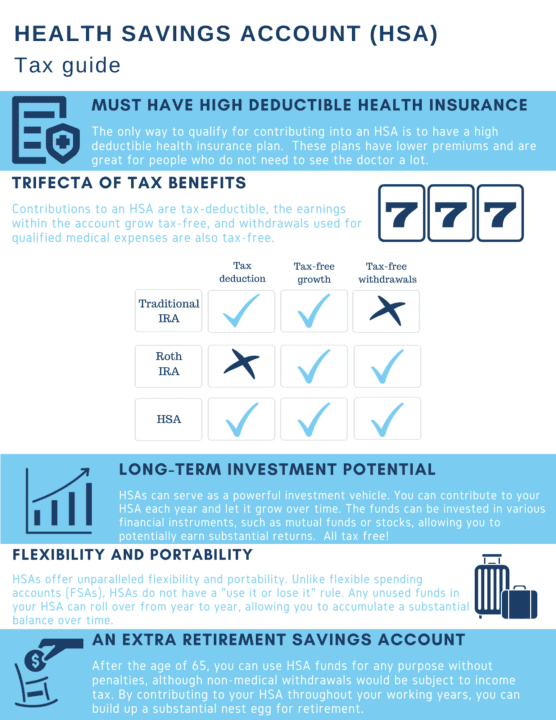

A Triple-Tax Benefit

HSAs offer participants an unparalleled triple tax benefit that is not available with any other tax-deferred investment option.

Allocating funds into a Health Savings Account (HSA) can help reduce taxable income. Qualified individuals can put pre-tax money into the account, which will be excluded from their gross income. If a person contributes to the HSA with after-tax dollars, they can deduct the amount from their gross income when filing taxes.

While your funds are held within an HSA and invested, they can grow and accumulate tax-free. You won’t be liable for any capital gains or dividend taxes annually on your investment gains. You can put your HSA funds into mutual funds, stocks, and other investment options. Depending on your investing interests, Molen Tax can assist you with this.

Withdrawals from your HSA are not subject to federal taxation in the event that they are used to cover eligible healthcare expenses. If the funds are used for any other purpose, the account holder will be subject to income tax on the withdrawal and a 20% tax penalty.

Save for retirement

Saving for retirement is a great way to ensure you are prepared for the high costs associated with healthcare during your retirement years. Using an HSA can help you accumulate funds for this purpose. Once you reach the age of 65, you can withdraw the money from the HSA without incurring any penalties.

Balance rolls over

Unlike a flexible spending account (FSA), the funds of a health savings account (HSA) do not need to be used up by the end of the plan year. The balance rolls over and there is no expiry date for the funds.

What Does an HSA Cover?

The Internal Revenue Service (IRS) outlines a range of commonly accepted items related to healthcare in Publication 502 that are considered “medical expenses.”

HSA funds can be used to pay for qualified medical expenses, including but not limited to:

- Qualified out-of-pocket medical expenses you incur that are not covered by your health plan

- Prescription eyewear and supplies

- Prescriptions medicines

- Routine physical examinations

- First aid and health monitoring supplies

- Drug addiction treatment.

- Mental health services

- Dental care

- Complementary treatments, such as chiropractor visits and massage.

- Fertility and maternity services

- Your kids’ and other qualified dependents’ health expenses

- Long-term care expenses

- Health insurance premiums (Medicare Part B, Part D, and Medicare Advantage premiums

- Lab tests

- Coinsurance

In addition, use your HSA to reimburse the mileage cost for trips to the doctor or medical center and to pay for lodging if medical attention in another city requires a person to stay overnight. Additionally, take advantage of your HSA funds for non-tax deductible COBRA and long-term care policy premiums.

Is there a downside to an HSA?

Yes, there are some potential downsides to having an HSA.

- HSA does not provide complete coverage for healthcare expenses

- You must have a high-deductible health plan

- Make regular contributions to anticipate future medical expenses

- Not all merchants accept HSA debit cards as a form of payment

- The interest rates tend to be relatively low, and certain trustees may impose a monthly charge if the balance dips below a specified limit.

- Keep receipts of all withdrawals to demonstrate that funds were used for eligible healthcare costs. This is essential if the IRS reviews your tax return.

Take Note Of The Following

· Suppose you are still determining whether your health insurance qualifies you for a Health Savings Account (HSA); contact the insurer to confirm. If you have obtained a plan through a federal or state exchange, the answer should be accessible through the exchange website’s plan information.

· When selecting an HSA, investigate any charges you may incur, the associated interest rates, and the investment choices available for funds you leave in your account.

· If you are eligible for an HSA, you can open one at any bank that offers these accounts, either in person or online. If your employer provides this benefit, you can arrange to have a certain amount of your salary put into your HSA account each month.

Get A Health Savings Account Now!

Health Savings Accounts (HSAs) could be an excellent choice if you’re young and in good health. You’ll pay low insurance premiums, save money for future medical costs, and benefit from tremendous tax advantages. I hope you now know whether or not you should open an HSA.

It is vital to bear in mind that not all HSAs are the same; some providers may charge extra for the debit card feature or the investment options of the account.

Molen & Asociates can assist you in choosing the best Health Savings Account for you. We will discuss the advantages and disadvantages to ensure you make the most of your medical expenditures. Get in touch with us, and we will walk you through your options as a business owner, employee, self-employed individual, or individual.