by Clark Boyd | Jul 6, 2020 | blog, Income

Transform Your Finances: Save on Taxes Now Tax law is constantly changing, and it is almost impossible to keep up with all of it, but thankfully, here at Molen & Associates, we are dedicated to help our clients save on taxes. With each new president or change in...

by Clark Boyd | May 26, 2020 | blog, Filing

Don’t Miss the New Tax Deadline: Key Updates for This Year There is a new tax deadline, now what? Most of you are aware that the new tax deadline for 2020 has changed to July 15th. Normally, if you don’t file your tax return and pay in full, you can expect penalties...

by Clark Boyd | Apr 30, 2020 | IRS

How to Minimize Penalties on 401(k) Withdrawals Life has a way of throwing curve balls at us. And they’re great at draining us of our money—especially if we’re not prepared. You’ve heard of Murphy’s Law, right? Anything that can go wrong will go wrong. Murphy is rude....

by Clark Boyd | Apr 13, 2020 | blog, Uncategorized

Law Enforcement Tax Returns: What You Need to Know We have all had the thought at least once in our lives… ‘what on earth is going on here’? Going over your tax return can easily be one of those moments. Having a professional to ask questions and help you walk through...

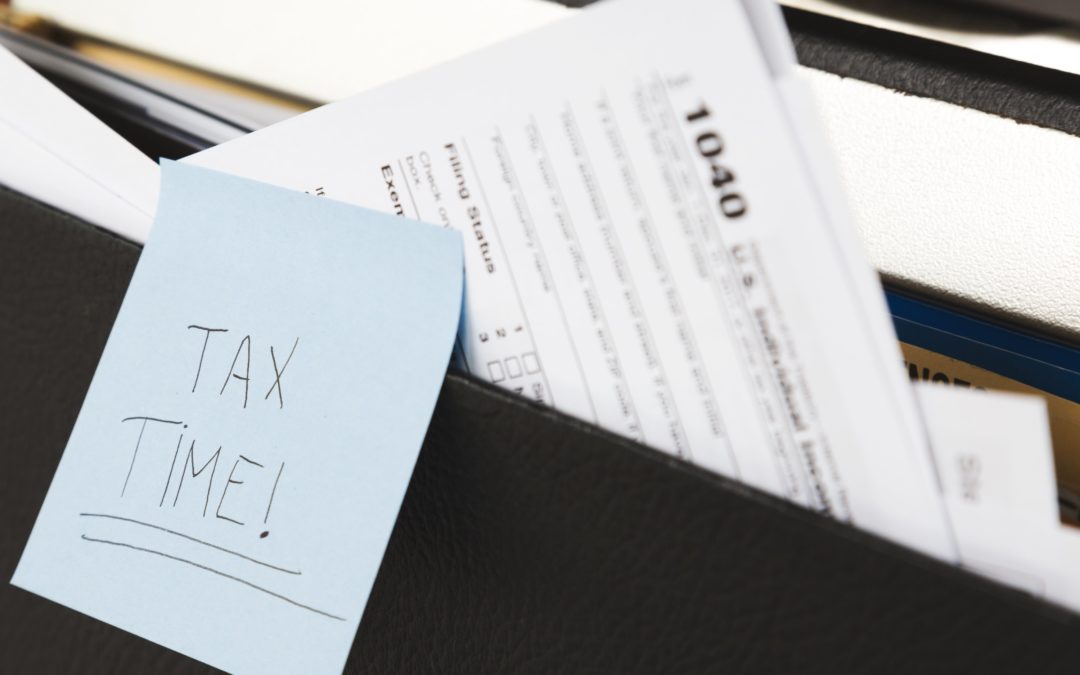

by Clark Boyd | Mar 30, 2020 | Uncategorized

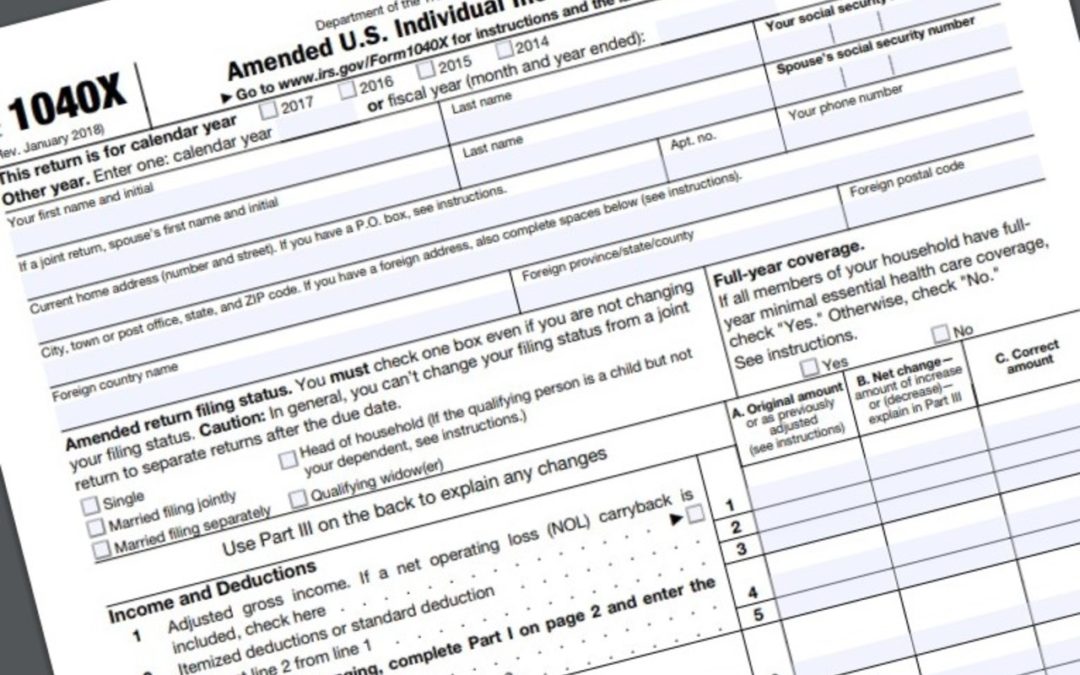

When should you amend your tax return? So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than once, but it is...