by Clark Boyd | Apr 13, 2020 | blog, Uncategorized

Law Enforcement Tax Returns: What You Need to Know We have all had the thought at least once in our lives… ‘what on earth is going on here’? Going over your tax return can easily be one of those moments. Having a professional to ask questions and help you walk through...

by Clark Boyd | Mar 30, 2020 | Small Business

Essential Tips for Small Business Owners on the CARES Act If you would like to listen to our webinar on the following information, click here. As a result of the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) passed by the Senate on Wednesday March...

by Clark Boyd | Mar 30, 2020 | Uncategorized

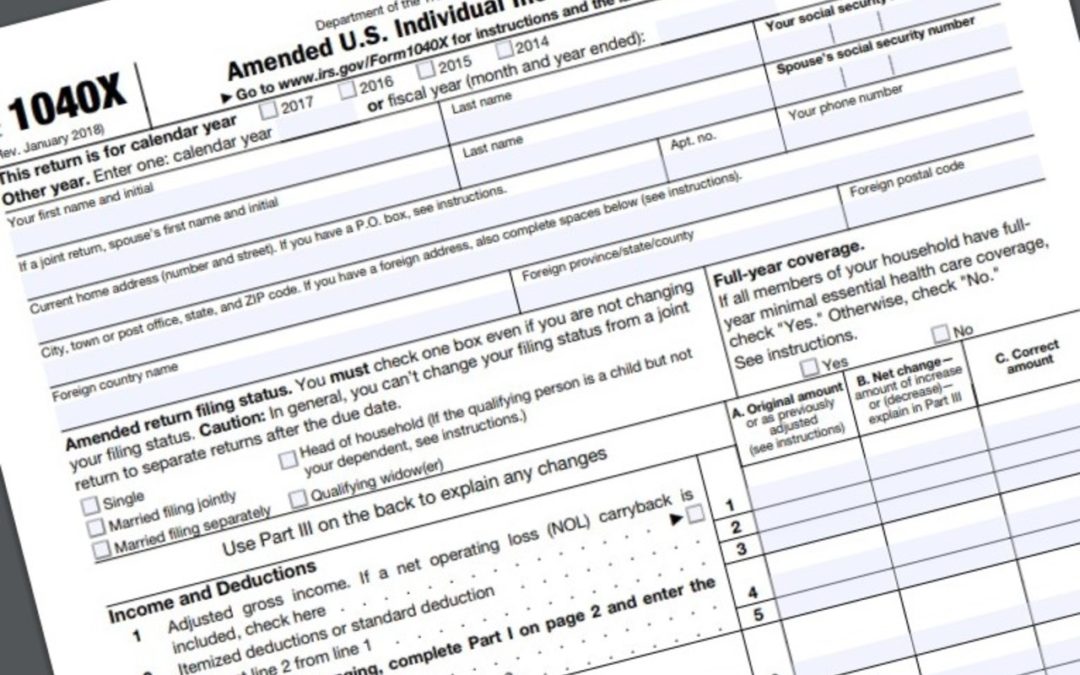

When should you amend your tax return? So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than once, but it is...

by Clark Boyd | Mar 29, 2020 | Uncategorized

Navigating the COVID-19 SBA Loan Application Process The COVID-19 pandemic has upended all aspects of life around the world, including the world of business here in the U.S. If your business is struggling, you may be able to get some help from the federal Small...

by Clark Boyd | Mar 29, 2020 | Uncategorized

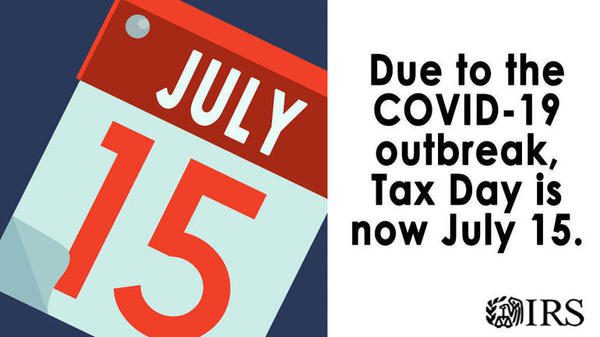

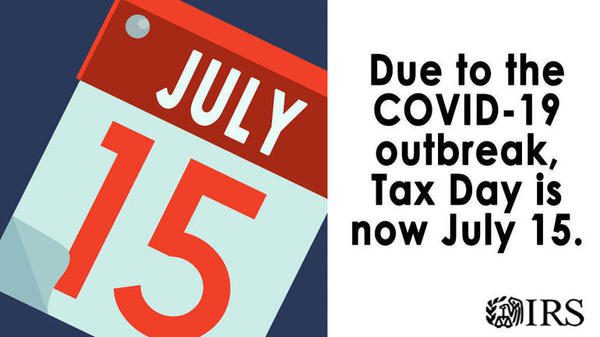

Recent Developments in COVID-19 Tax Filing Deadlines As you know, the COVID-19 pandemic has shut down much activity in the United States. The IRS decided to use its authority in a national emergency to postpone certain tax return filings and payments. This change...